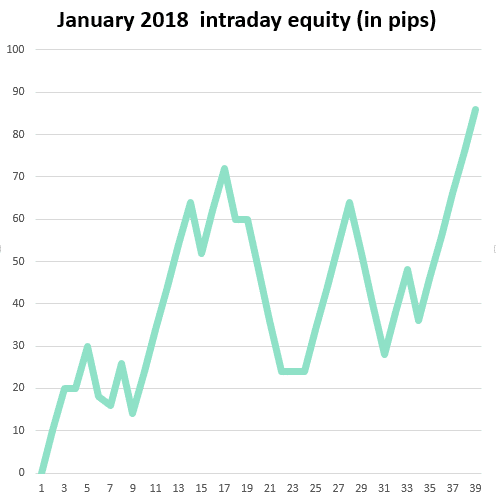

Volume Profile Trading Strategy – January 2018 Trade Recap

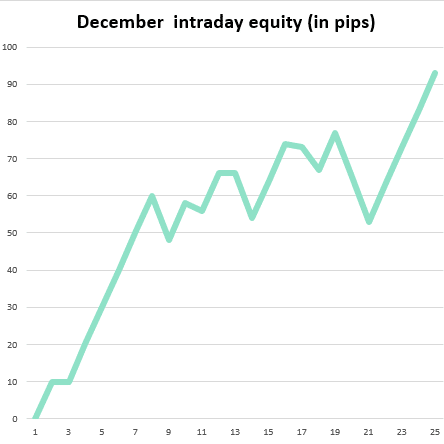

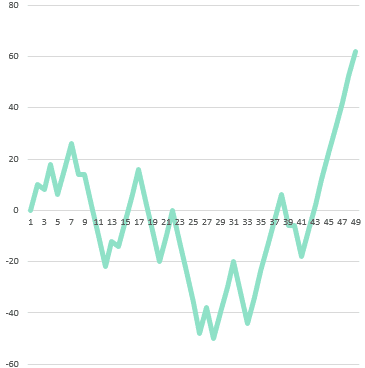

After quite a slow December, January returned back to the usual and the number of trades went back to the average 30-40/ month. Let’s have a look at the December trades which originate from the trading levels I publish in my daily levels table. To start let’s cover the intraday trades and then I will go into […]

Volume Profile Trading Strategy – January 2018 Trade Recap Read More »