Hello guys,

in today’s analysis, I would like to talk about a trade I had yesterday on USD/JPY (futures symbol: 6J 03-21).

This trade was particularly interesting because this trading opportunity would be COMPLETELY HIDDEN from everyone who does not use Volume Profile or Order Flow.

Let me start from the beginning…

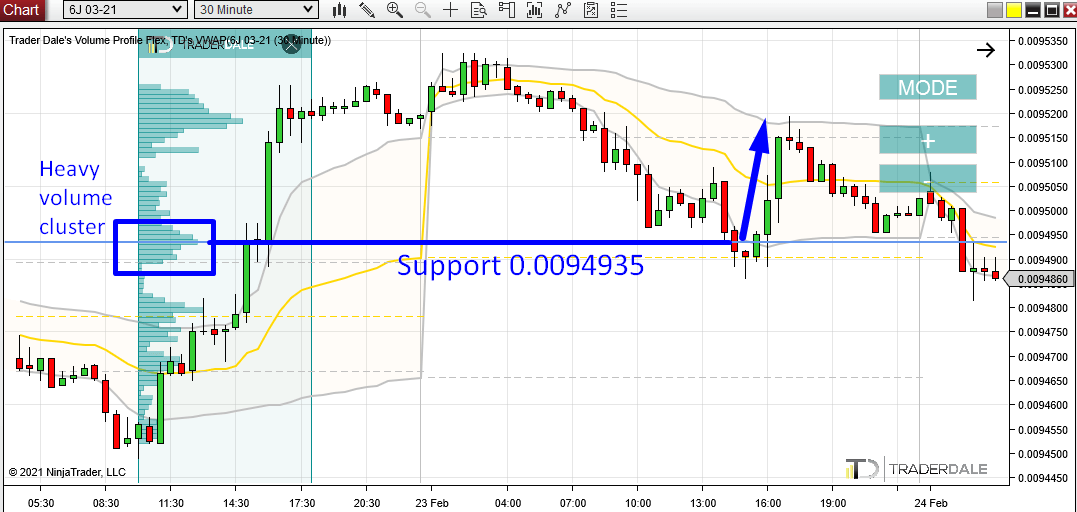

There was a day trading support on JPY Futures (6J 03-21) around 0.0094935. I was talking about my intention of trading this in my Members area in my Daily Levels Commentary video.

This trading level was based on a Volume Profile setup called the “Trend Setup“.

Volume Profile – Trend Setup

The main idea behind this setup was that the price was going upwards and that there were heavy volumes (Volume Cluster) created within this up-move.

Such a Volume Cluster indicates that Buyers were adding to their Long positions there.

To trade this setup, you simply wait for a pullback and go Long from this area. The reason the price should go up again is that Buyers should defend this zone (it is important for them) and push the price upwards again.

You can learn more about my Volume Profile setups for example in this webinar:

Volume Profile Setups (WEBINAR RECORDING)

This trading opportunity was completely invisible for everyone who does not use Volume Profile. That’s why I like trading with Volume Profile so much!

Check the Support out on the JPY Futures (6J 03-21); 30 Minute chart below:

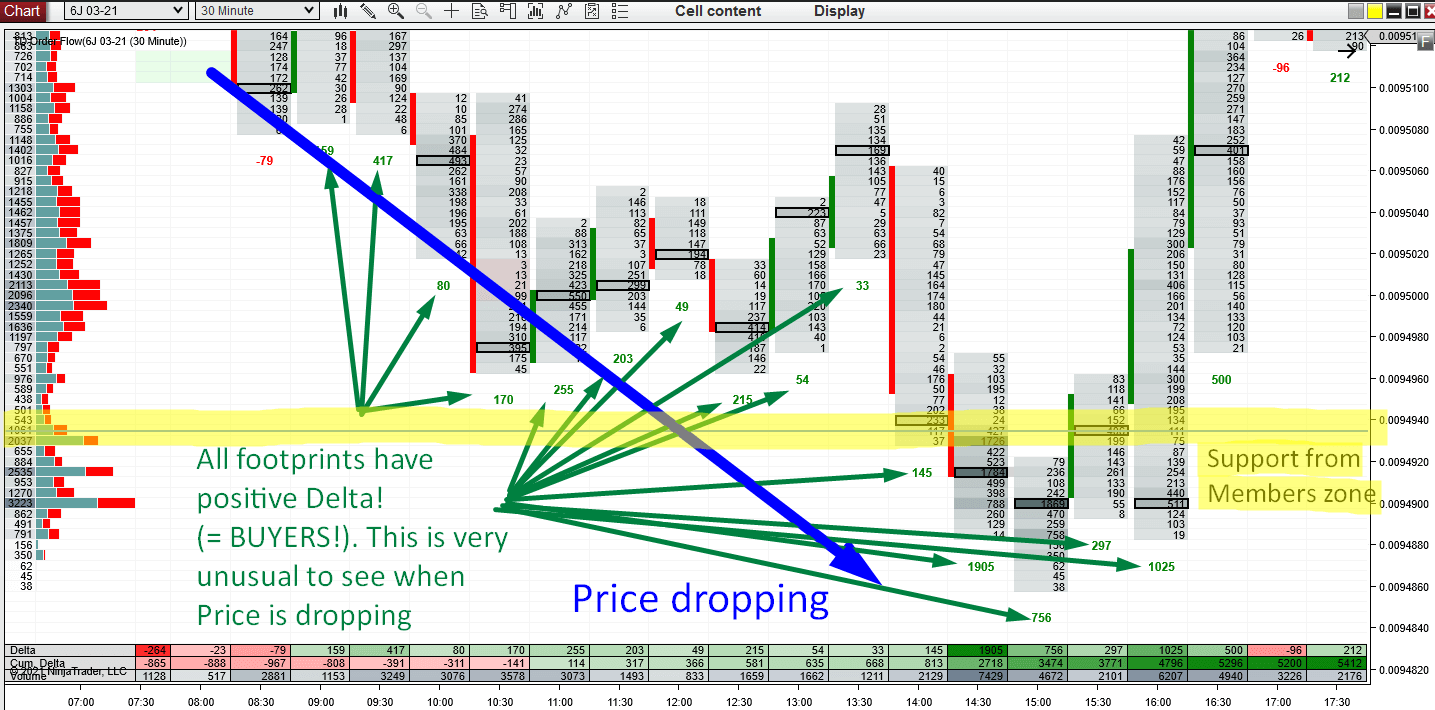

Order Flow

I was shooting my members Daily video, when there was the rotation before the level got hit. In this video, I said that I wanted to see some confirmation of this trade on Order Flow software.

And this brings us to the Order Flow webinar which I had a couple of days ago. One of the

“confirmation setups” I showed at the webinar was a “Divergence between Price and Delta”.

If you don’t know what “Delta” or “Price and Delta Divergence” means, then I suggest you check out the webinar recording here:

ORDER FLOW: Trading Setups (WEBINAR)

In this trade yesterday, there was one of the craziest and biggest divergences I ever saw.

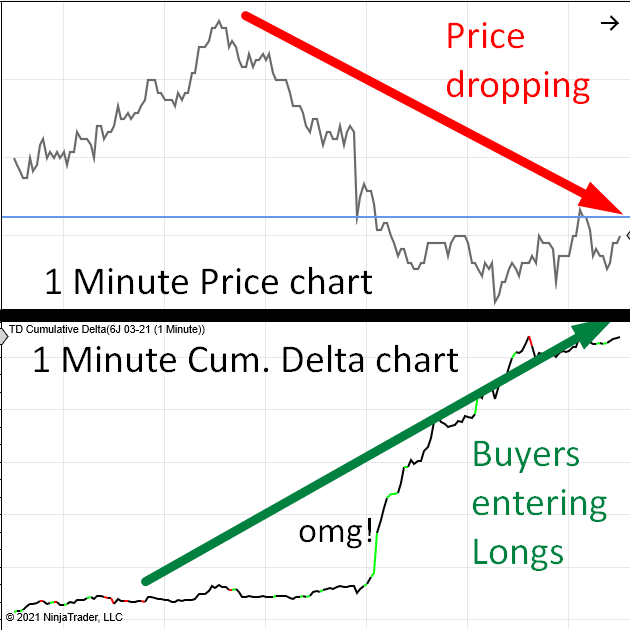

The price was dropping but Buyers were entering their Longs like crazy!

Check it out on this 30 Minute Order Flow chart:

Do you want ME to help YOU with your trading?

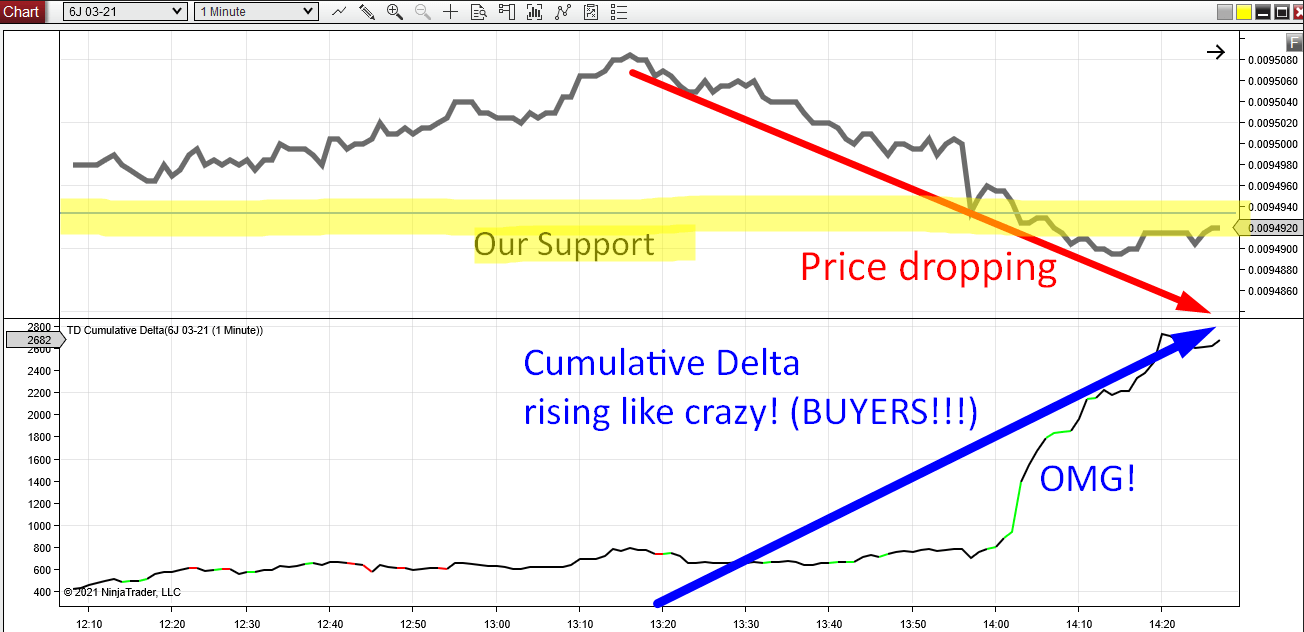

Price vs. Cumulative Delta (DIVERGENCE)

Let’s have a look into a more detailed chart, which shows 1 Minute Price versus 1 Minute Cumulative Delta (this is where I mostly look for divergences).

Below, you can see what happened when the price hit the Support zone:

The Price went below my trade entry, but Cumulative Delta was rising like crazy and it was literally shouting at me: BUYERS, BUYERS, BUYERS!!!

This was a very strong confirmation that the Price would most likely turn upwards – strong Buyers were making their move there. This is exactly what you want to see. This is what trade entry confirmation is all about!

Now, if the price was just rotating below my Long entry without this Delta confirmation, then I would be pretty nervous. I would most likely try to quit the trade around Break Even. BUT because there was this massive divergence, I was pretty confident and almost certain that the price will rise dramatically.

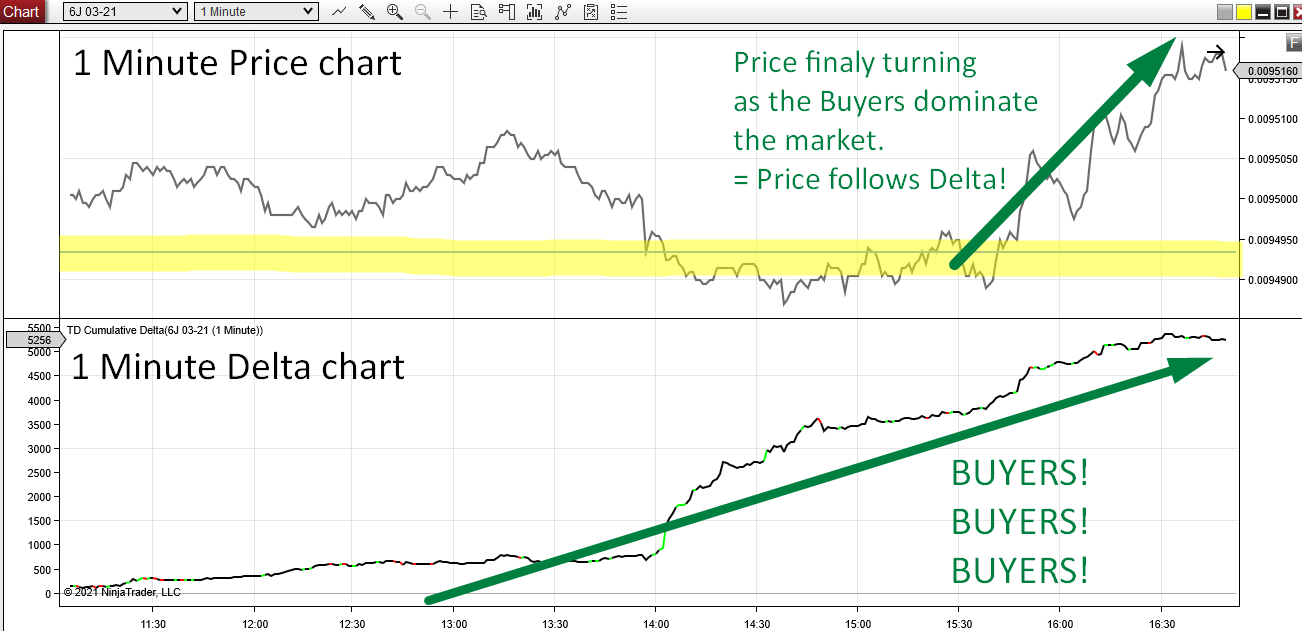

That’s exactly what happened. Check it out on the chart below:

An Invisible Trading Opportunity

What I like about this the most is that this trade was completely invisible to everybody who does not follow volumes.

Trade entry was based just on volumes. Then when the price hit the Support, we used Order Flow to see what was going on. People without Order Flow or Delta would not see it! They would just see the price shooting past their level without much of a reaction.

See the difference? That’s exactly what I was talking about at the Order Flow webinar!

I hope you guys liked this trade analysis. Let me know what you think in the comments below!

Happy trading!

-Dale

Thank you for your detailed analysis of the trade above. I had given up on trading. I like your master-ship on trade and before the end of the month will be in fully using your software.

Hi Samuel, thank you for your comment.

I’m happy to hear I gave you the will to trade again with my analysis. 🙂

Cheers!

Hi I recently purchased your elite package and am liking it very much.

I trade crypto and before I purchase ninja Trader license to get the volume profile tools, do you know if the data fields available for crypto in ninja trader support using them? I’ve tried other platforms and the volume data available cant support volume profiles and foot print charts.

Thanks

Hi James, thanks for your kind feedback, I’m happy to have you here!

You can connect to Coinbase in Ninja literally with one click. Just go to the control center -> connections -> configuration and add it, if it’s not already added to your list when you just click on ”connections”.

Cryptos work well with my volume profile and vwap, but you can not get it on order flow because cryptos are a decentralized market and therefore we will never see bid x ask data there.

Dale,

Excellent review. I really like the Delta conformation with the VP setup. I’m working through the Elite course and plan on getting the OF package as well. Thanks for all you do.

Thank you for your feedback Brent, appreciate it!

Dale, I just purchaded your software… Its been working fine! But, now when I Apply it on a chart, it

shows the area box on chart , but not the profile.. Im not sure what happened…..can you help?

Thanks, Rick Keyser

Hello Ricky,

Please email the screenshot of the chart on my email contact@trader-dale.com