Webinar content:

- Order Flow basics

- Active vs passive market participants

- How to make reading Order Flow easy

- Order Flow standalone setups

- Order Flow trade confirmation setups

Order Flow Special Offer: https://www.trader-dale.com/order-flow-indicator-and-video-course/

FREE GIFT (Order Flow book): https://www.trader-dale.com/download-your-free-book/

Q/A

Thanks for so many GREAT questions I have received after my recent the Order Flow webinar! You can check these questions along with my answers below!

Technical

Do I need to purchase NinjaTrader 8 full version to use your software?

It’s okay to use their “free” version. I am using their “free” version too. All my software works there without any problems.

Yes, it works on all markets and instruments.

Yes, you can but you need data-feed for stocks. Best to contact NinjaTrader support about this, tell them what exactly you need and what stocks you want to trade. They will get you a quote and help you connect to data.

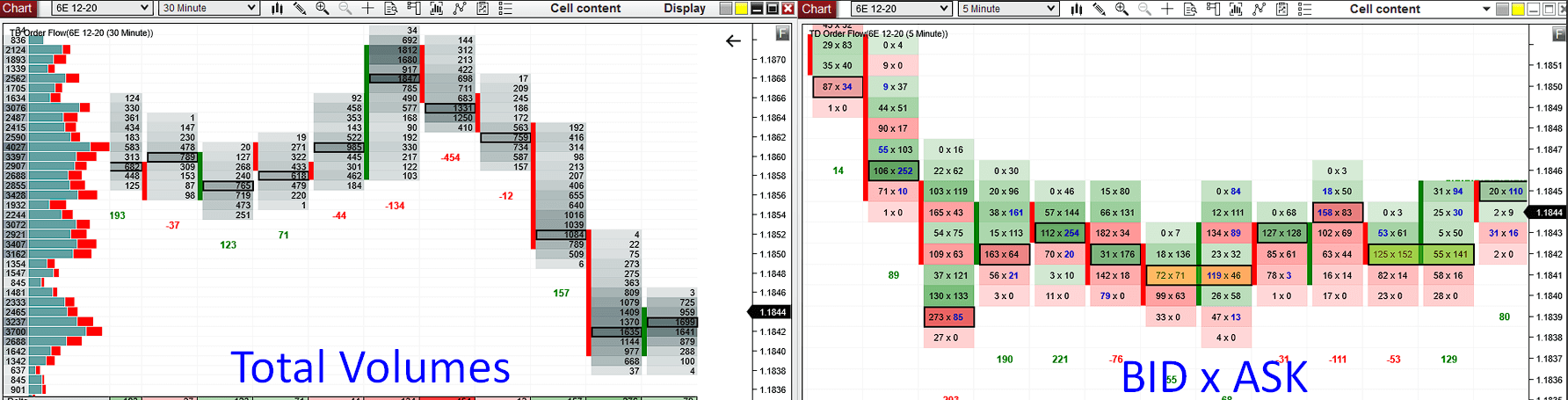

Can you use Order Flow on Forex?

Yes, but the features will be a bit limited since you won’t get separate Bid x Ask data. Only Total Volumes. Still, you can use Order Flow with setups which do not use Bid x Ask, but work with “Total Volume” footprints instead. More on this in my Order Flow trading course.

What you can also do, and what I do is that you look at currency Futures (those provide Bid x Ask data) and then, on another platform you trade Forex. For example – One screen with NinjaTrader 8 shows 6E symbol (EUR futures) and Order Flow, and your second screen shows your MT4 platform where you trade EUR/USD (Forex). Those two instruments move almost 100% the same way (their correlation is very close to 100%). It is really simple!

More on this in my Order Flow training course.

Does it work on all time frames?

Yes, it does work on all time frames. Generally speaking – Order Flow is best used for day trading. This means faster time frames, like 1 Minute to 60 Minute charts.

Can you use it on 1-minute chart?

Yes.

Do you need level 2 data for it?

No. Level 2 data shows market depth which the Order Flow does not use. You only need standard Level 1 data.

Is the Order Flow a part of the Elite Pack?

Order Flow indicator is only part of the Order Flow Pack. It is not included in the Elite Pack.

You can read about content of each pack here:

Can I have it on more than one PC?

You can have the Order Flow software on 2 computers. If you want more, then it is extra $50 per license.

Strategy

If there is a rotation, then institutions often mix Limit orders and Market orders in order to get into their positions unnoticed and to hide their intentions. This is usually their goal when there is a rotation (to enter their positions unnoticed). They use “iceberg orders” (they split their orders into very small positions) and they use both Limit orders as well as Market orders. For this reason, it is very difficult to say what is going on in a rotation.

How do you detect that the market is going sideways with Order Flow?

If you want to tell when the market starts to rotate, then instead of Order Flow I would check Volume Profile. For example: P-shaped Volume Profile after an uptrend means that the trend has most likely ended, at least for now.

You can check this free mini Volume Profile course

Another great tool for telling apart “trend” and “sideways development” apart is VWAP. It is very simple. You can learn it for example in this VWAP webinar recording:

VWAP Trading Setups (WEBINAR RECORDING)

I think it depends on his strategy. With my strategy there is no problem with high liquidity instruments. My most favorite instrument is 6E (EUR futures) which is by far the most liquid currency Futures! Thanks to the special features my Order Flow has it is easy to read it and understand even markets with high liquidity. I never really had problems with that.

There is a scenario that could cause this. Imagine that the price goes downwards and hits a Buy Limit Order. This Buy Limit order would show on Bid and therefore it would cause a drop in Cumulative Delta (even though it was Buyers!).

That’s why I said in the webinar that Delta is not a Holy Grail – Limit Orders can mess it up. If there were no Limit orders, then Delta probably would be a Holy Grail 😊.

After such a scenario I would expect Aggressive Buyers start to jump in quickly, turning the Delta upwards again. Because of this, such a divergence should not take too long and Delta should start to follow the Price soon.

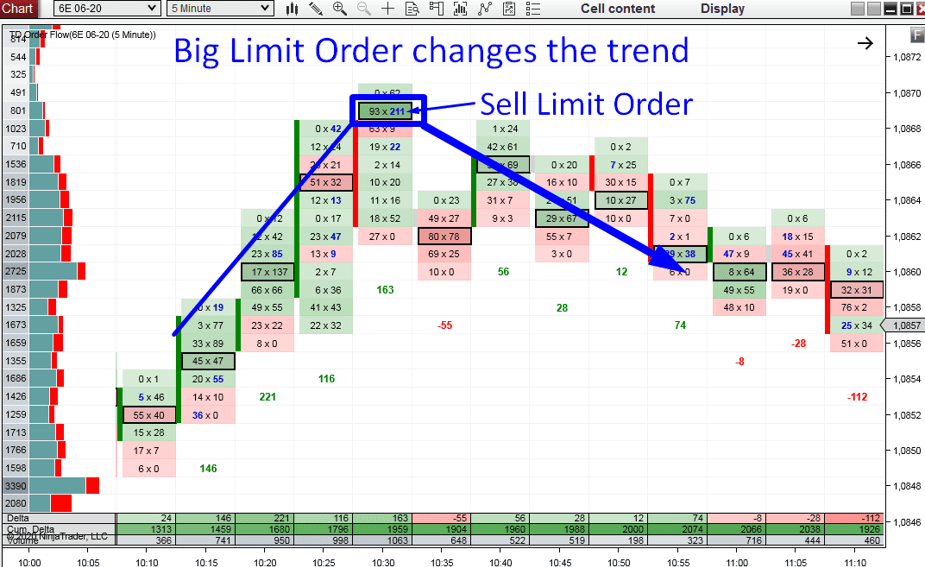

If it were 211×93 then it would either mean Aggressive Sellers or Passive Buyers. In such case, I would lean towards thinking that those guys were Aggressive Sellers (because the price was in a Resistance zone).

As a confirmation, I slightly prefer Limit Order. A situation where the high-volume node is 93×211.

A confirmation I like the most is when a Limit order is followed by Aggressive orders. This means that first, a BIG institution jumps in a trade with a Limit order and quickly after that other Aggressive market participants start to jump in with Market Orders.

I write more about that in my Order Flow book. Check it out!

When the price goes up after hitting a Support zone, but Delta does not follow, then I consider it a warning. The reason is that the Price is rising, but the Aggressive buyers are missing. You need to see them present to push the price up. Up move without strong Buyers is short lived. In such a case it is better to take a small profit and quit the trade before the price turns downwards again.

There could be such a scenario when there is a big Limit order (driving delta downwards), but after this, the Aggressive market participants should jump in quickly and join the party (and drive the Delta up again). If this does not happen quickly, then it is best to take a small profit and quit the trade.

Is it suitable for swing trading?

No, it isn’t. Order Flow is best for scalping and intraday trading. The best tool for swing trading is Volume Profile.

What’s an average Stops and Targets used?

It’s hard to tell a precise number because different trading instruments have different volatility. Very roughly 10 pips on major currency pairs (EUR, AUD, CAD, JPY…)

Can you combine it with other indicators?

Absolutely. It works best with Volume Profile! That’s how I use it and how I can teach you to use it in my Order Flow trading course.

If you meant like in one window (for example you have OF + EMA in one window), then this is not technically possible with my Order Flow. If you want to do this you simply open another window with another indicator there. I also do it this way. My day trading workspaces consist of 4 or 7 charts (depending on the number of screens I use).

Timing your entry is the biggest challenge when trading Price x Delta divergence as a standalone trading setup. For this reason, I prefer to trade this setup only when the Price reaches a Volume Profile based Support/Resistance zone. Otherwise, it would be pretty hard to tell when to pull the trigger.

When I see the divergence around my S/R level, I just enter the trade right away. Simply put: if the price is in a S/R zone and I spot a divergence I am in. Immediately.

I hope you guys liked the webinar! Let me know what you think in the comments below!

Happy trading,

-Dale

Thanks for the useful webinar.

Thank you for being there buddy.

Very informative!

I wouldn’t mind a live trading session sometime!

I uploaded this video one day before your comment: https://www.trader-dale.com/order-flow-volume-profile-live-trading-usd-cad-futures/ 🙂

Thanks so much for the informative webinar and the above follow up Q&A. In the above Q&A you say OF is suitable for intraday trading but not for swing trading. Could you tell us the reason why this is the case, like why we don’t use OF with daily timeframe?

You would simply get lost in all the details. For swings, you need a way bigger picture! You need to see places where heavy volumes were traded on the bigger scope.

Hi, Dale! You said that it is possible to look at currency Futures and on another platform trade Forex. How can I make proper analysis if Futures data is delayed 10 minutes. Why it is delayed? Does it mean it is not good idea to trade on smaller timerframes?

Hello,

futures is not delayed. For Order Flow trading you need real time data. I think you need to ask your data provider about this.

hi Dale,

Am I correct to understand that we can daytrade Futures using OF?

Yes, we can daytrade futures with OF tool