Hello guys,

today I would like to have a closer look at the EUR/AUD.

Rotation And A Trend

If you look at simple Price Action then you can see there was a price channel starting 7th September and lasting until today.

What happened in today’s Asian session was that the price broke out of this channel. It seems a new uptrend has started.

Before almost every new trend, there is always a rotation or a price channel. Why? Because the BIG trading institutions who move and manipulate the markets have insane amounts of money which they need to allocate before the trend starts.

They enter their trading positions slowly and unnoticed in rotation zones – just like the one on EUR/AUD.

Volume Profile Analysis

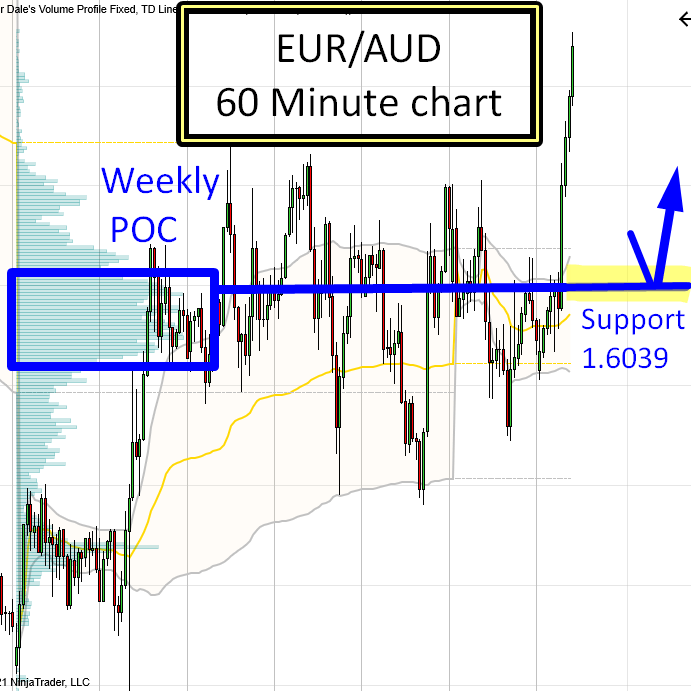

Let’s now have a look at the picture below. What does it tell us? There was a rotation with heavy volumes accumulated there (BIG trading positions being entered). You can see that if you use my Volume Profile tool.

Then, a new uptrend started. This indicates that strong institutional Buyers were building up their Long positions inside the rotation and then manipulating the price into the new trend.

EUR/AUD, 60 Minute chart; Weekly Volume Profile:

Now, we know that there were strong Buyers in that rotation. It is pretty likely that those Buyers will want to defend the place where they were entering their Longs before.This place was clearly important for them.

This is why I think that the zone starting around 1.6039 will work as a strong day trading Support.

The Volume Profile setup I used here is called the “Volume Accumulation Setup“

Weekly Point Of Control (POC)

If you look at the picture again, you can see that the heavy volume area was actually a Weekly Point Of Control (POC). This means the heaviest Volumes throughout the previous (and this) week were traded there.

Volume-wise, this is the most important area in the whole chart right now.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

After the buyers have accumulated their position, what is the actual mechanism used to manipulate the market to create the new breakout and upward trend.

They start buying using Market Orders. Buying at the Ask price makes the price move upwards as the Buyers are more aggressive than sellers.

If the idea is to create an upward trend, do the institutions then take profit to then create a downward trend? If they do this then there is no support level to defend if they have closed out their position. Unless the downward trend is created by a build up of Shorts combined with the taking of profits? What is the actual mechanism to trigger a trend?

Yea, they can take the profits and go away. But the zone where they accumulated longs at first place is still an important zone as it previously worked as a good zone to provide liquidity for their volume accumulation. Chances are this zone will work as a good liquidity zone again.

A trend is triggered when one side of the market (for example buyers) is way more aggressive than sellers. They want to jump into a Long trade no matter what – no matter the price is no longer as low as it was. They just want in now.

Check out this article: https://www.trader-dale.com/market-vs-limit-orders-which-one-to-use/

Your volume profiles worked perfectly today both for CADJPY and NZDJPY. Though there was fundamental ( US CPI news), sellers aggressively defended their positions. Managed to hit 21 pips and 15 pips respectively

Good job!