Hello guys,

today, I would like to have a closer look at the NZD/CAD.

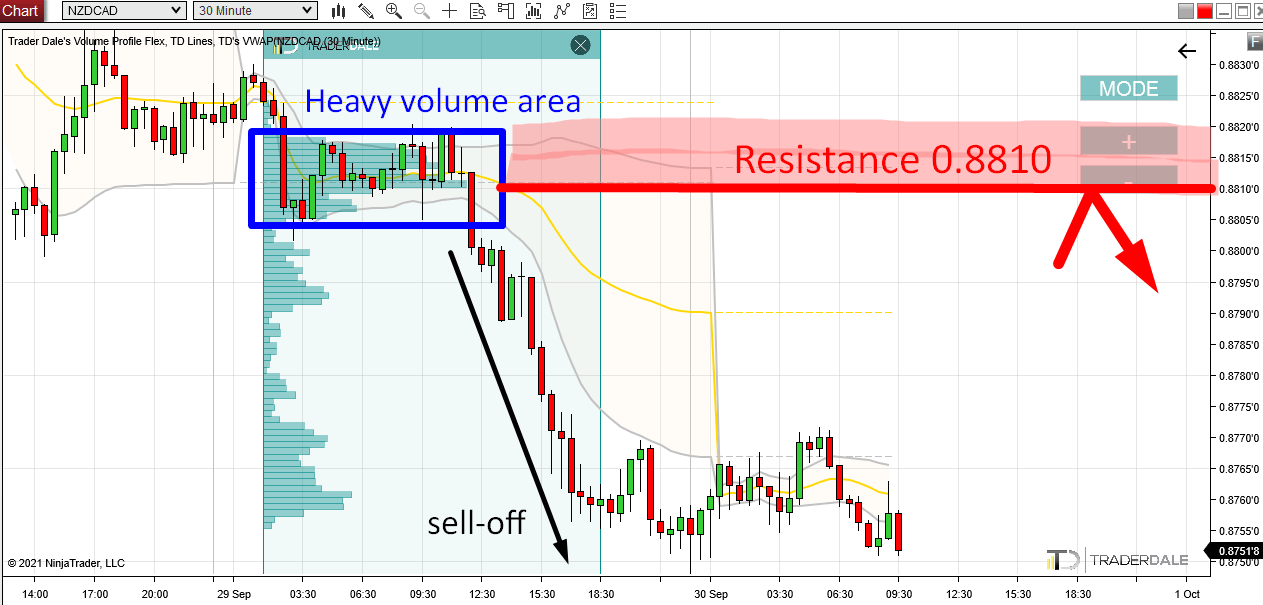

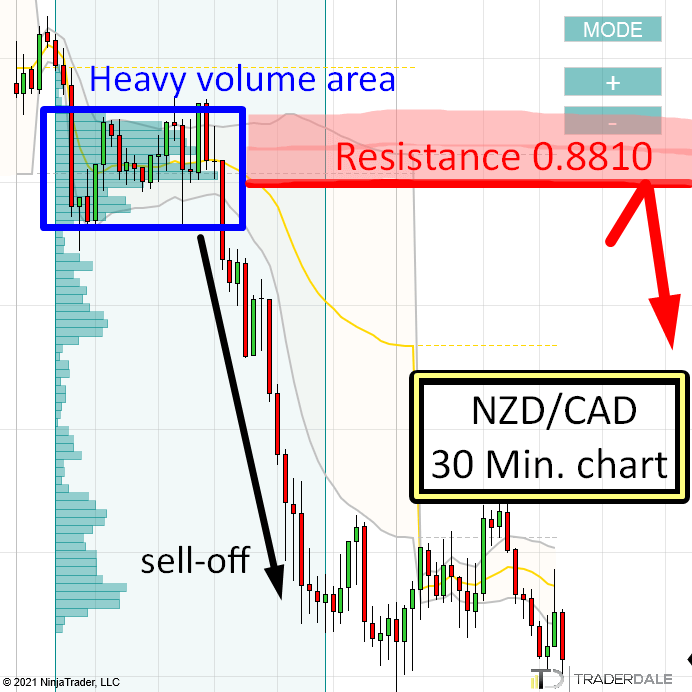

What caught my eye here was a Price Action formation: “Rotation followed by a sell-off”.

In the picture below I marked the rotation in blue and the sell of in black.

When I see such a formation, then my next step is that I use my Flexible Volume Profile to look into that rotation to see how volumes were distributed there.

As you can see, the Volume Profile is quite wide there, which means that heavy institutional volumes were traded there.

It tells us, that there were strong institutional Sellers who were accumulating their trading positions there. Were those Longs or Shorts?

It were Shorts because the price went into a rapid sell-off afterwards. The BIG guys were building up their Shorts and then they manipulated the price to shoot downwards. That’s how it works.

Those BIG guys accumulated most of their trades in the heavy volume zone starting around 0.8810.

NZD/CAD, 30 Minute chart:

Now that we know there were strong institutional Sellers active around 0.8810 we can adapt to that.

Pullback to 0.8810

What we can do is wait for a pullback to this area (0.8810) and then trade with those Sellers once more.

This zone is clearly important for them since they placed a lot of their Shorts there so chances are they will want to trade here again.

When the price makes it back to the area around 0.8810 we can expect those Sellers to become active again and to try and push the price downwards from here again.

This should make the zone around 0.8810 a strong day trading Resistance.

This Volume Profile setup is called the “Volume Accumulation Setup“. It is my favorite Volume Profile setup and you can learn all there is about it in my Elite Pack Trading Course.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

hi dear dale

thank you for reply my question

my base currency is US dollar

what happen when i sell NZD against CAD? is my profit affected by USDCAD rate?

how to consider it?

I apologize for the weak English language

Hello, if you trade NZD/CAD then you wont be affected by usd/cad rate

Hi Dale

I think poc acts as a magnet. Is it true?

I mean it can be reasonable to buy below it and sell above it?

Hello,

I get what you mean but I don’t really trade like this. Only when the price is in a rotation channel. then its a viable setup. Ideally combined with VWAP!

When price gets back up to that level the bug guys must have already covered their shorts? So why would they push it down again??

Hello,

yea they might already covered their shorts, but there are more factors to this. You can learn more about it in my Volume Profile book – available for free on my website.