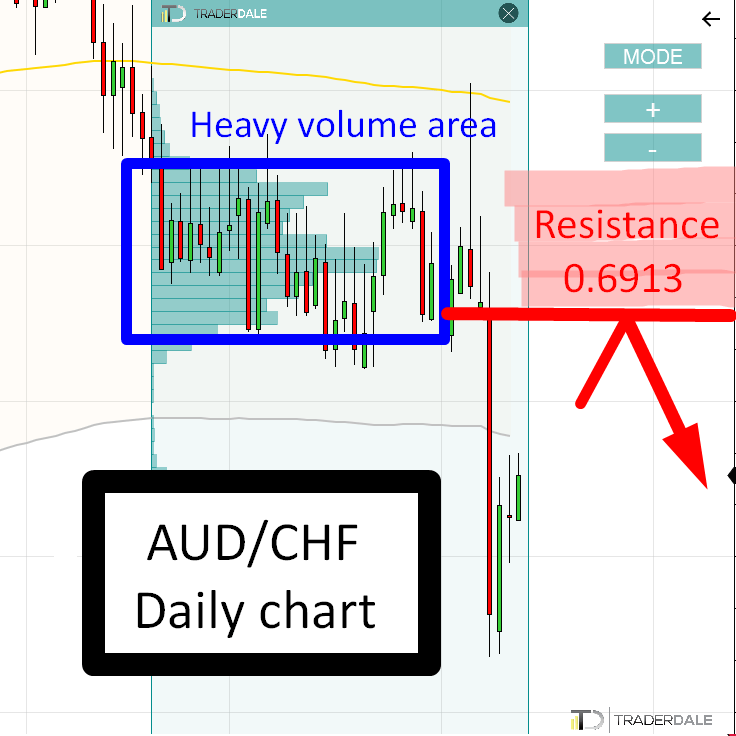

AUD/CHF: Swing Trading Analysis With Volume Profile And Price Action

This Swing trading analysis will show you how to use Volume Profile and Price Action to identify a strong institutional Resistance that has just formed on the AUD/CHF.

AUD/CHF: Swing Trading Analysis With Volume Profile And Price Action Read More »