Forex Trading Articles

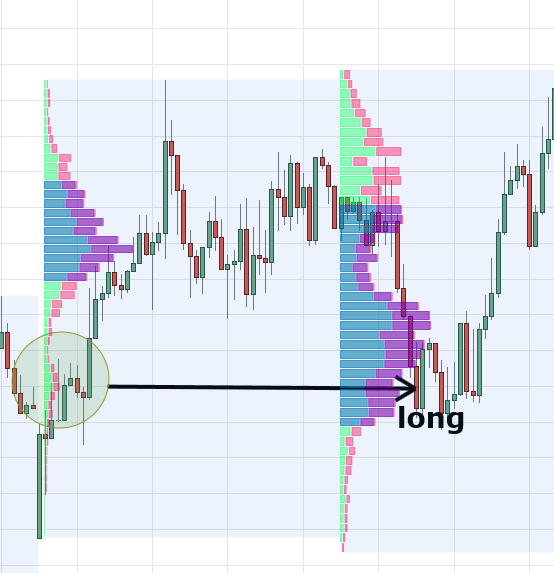

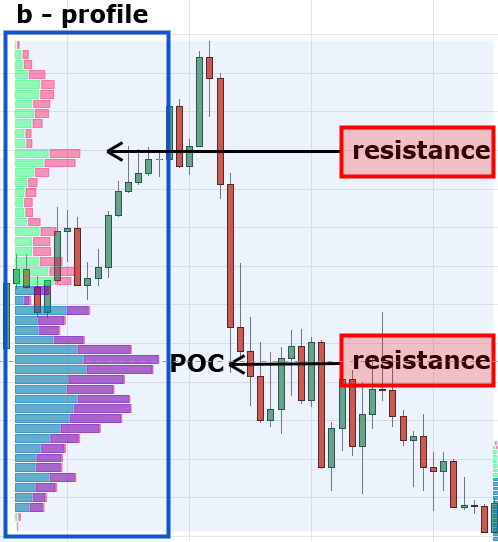

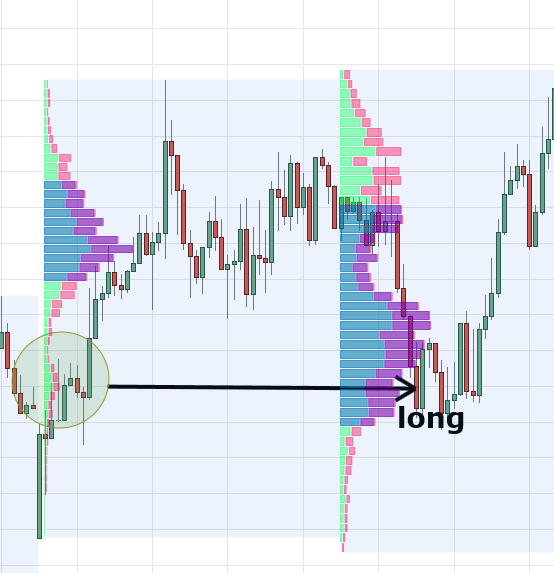

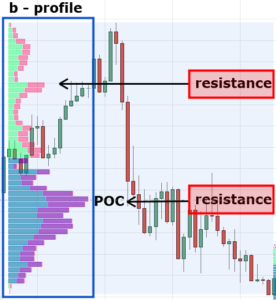

Market Profile 3 – my real trades

Hello guys, hopefully you read my previous articles Market Profile 1 – introduction and Market Profile 2 – different profiles and their application. If not

Market Profile 2 – different profiles and their application

Hello my friends! In the previous article Market Profile – introduction I briefly mentioned that there are some different shapes of Market Profile histograms (profiles). I

5 phases of backtesting and implementing new ideas

Hello my friends, today I would like to tell you about my way of backtesting new trading ideas and implementing them in my trading. At

Price Action Part 3 – Quickly Identify Strong or Weak Highs and Lows

Hello my Friends! In my article, Price Action – Aggression which you can read by clicking HERE, I was talking about aggressiveness in the market

Price action 2 – how to identify big players

Hello my friends! Hopefully you read my previous article Price Action – aggression and you can now identify aggresive trading activity just by watching plain

Price action 1 – aggression

Hello my friends! Today I would like to tell you something about my way of using price action. Let me start with a question: What

Basic trading rules for intraday levels

Understanding levels I trade all my levels when the price reaches them. If I have for example 2 short levels it doesn’t mean that price

Don’t let a good day turn into a bad day!

Sometimes there are days when the market does exactly what you want. For example today’s EUR/USD. Both my short and long levels were hit, the

Alternative approach – by Ziggy

Here is an article written and kindly provided by my friend Ziggy. He is a professional trader and this is his alternative way to approach

Position management – Swing trades

SL For every swing trade I use different SL. It is because I search the chart for the best place for the stop loss order.

Market Profile 3 – my real trades

Hello guys, hopefully you read my previous articles Market Profile 1 – introduction and Market Profile 2 – different profiles and their application. If not

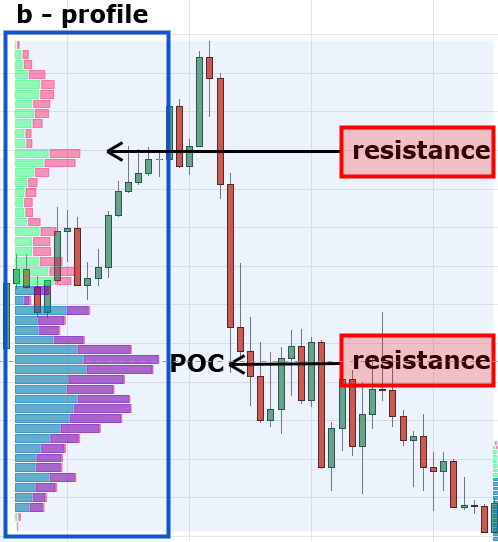

Market Profile 2 – different profiles and their application

Hello my friends! In the previous article Market Profile – introduction I briefly mentioned that there are some different shapes of Market Profile histograms (profiles). I

5 phases of backtesting and implementing new ideas

Hello my friends, today I would like to tell you about my way of backtesting new trading ideas and implementing them in my trading. At

Price Action Part 3 – Quickly Identify Strong or Weak Highs and Lows

Hello my Friends! In my article, Price Action – Aggression which you can read by clicking HERE, I was talking about aggressiveness in the market

Price action 2 – how to identify big players

Hello my friends! Hopefully you read my previous article Price Action – aggression and you can now identify aggresive trading activity just by watching plain

Price action 1 – aggression

Hello my friends! Today I would like to tell you something about my way of using price action. Let me start with a question: What

Basic trading rules for intraday levels

Understanding levels I trade all my levels when the price reaches them. If I have for example 2 short levels it doesn’t mean that price

Don’t let a good day turn into a bad day!

Sometimes there are days when the market does exactly what you want. For example today’s EUR/USD. Both my short and long levels were hit, the

Alternative approach – by Ziggy

Here is an article written and kindly provided by my friend Ziggy. He is a professional trader and this is his alternative way to approach

Position management – Swing trades

SL For every swing trade I use different SL. It is because I search the chart for the best place for the stop loss order.

Market Profile 3 – my real trades

Hello guys, hopefully you read my previous articles Market Profile 1 – introduction and Market Profile 2 – different profiles and their application. If not

Market Profile 2 – different profiles and their application

Hello my friends! In the previous article Market Profile – introduction I briefly mentioned that there are some different shapes of Market Profile histograms (profiles). I

5 phases of backtesting and implementing new ideas

Hello my friends, today I would like to tell you about my way of backtesting new trading ideas and implementing them in my trading. At

Price Action Part 3 – Quickly Identify Strong or Weak Highs and Lows

Hello my Friends! In my article, Price Action – Aggression which you can read by clicking HERE, I was talking about aggressiveness in the market

Price action 2 – how to identify big players

Hello my friends! Hopefully you read my previous article Price Action – aggression and you can now identify aggresive trading activity just by watching plain

Price action 1 – aggression

Hello my friends! Today I would like to tell you something about my way of using price action. Let me start with a question: What

Basic trading rules for intraday levels

Understanding levels I trade all my levels when the price reaches them. If I have for example 2 short levels it doesn’t mean that price

Don’t let a good day turn into a bad day!

Sometimes there are days when the market does exactly what you want. For example today’s EUR/USD. Both my short and long levels were hit, the

Alternative approach – by Ziggy

Here is an article written and kindly provided by my friend Ziggy. He is a professional trader and this is his alternative way to approach

Position management – Swing trades

SL For every swing trade I use different SL. It is because I search the chart for the best place for the stop loss order.

Facebook Posts

In today’s breakdown, our Head Trader Vivek walks you through a textbook Reclaimed Inversion Long setup that unfolded in real time.

First, price aggressively swept the Asia low—a classic liquidity grab.

Then it reclaimed a key inversion zone and printed a bullish order block, giving a clean long entry.

Even in a choppy, uncertain market, Vivek showed how sticking to the model—waiting for opposing liquidity to be taken, looking for engineered targets like equal highs, and confirming bullish intent—can still produce a high-probability, risk-controlled trade.

🎯 Target? The equal highs.

📊 Result? Trade worked perfectly.

🎥 Watch the full recap and learn how to spot this setup in your own trading!

www.trader-dale.com/reclaimed-inversion-order-block-setup-that-hit-target-live-trade-breakdown-9t...

P.S. Want to trade like a pro and finally get funded? Our 🎓 Funded Trader Academy gives you direct access to our team of experienced prop traders, personal mentorship, and a proven road map to secure funding.

Click the link below to see how it works:

👉 trader-dale.com/funded-trader-academy

... See MoreSee Less

- likes 2

- Shares: 0

- Comments: 0

0 CommentsComment on Facebook

Check out my latest market commentary, where I will show you the strongest Volume Profile trading levels to trade this week!

Enjoy!

www.trader-dale.com/top-volume-profile-levels-to-trade-this-week-on-gbp-usd-usd-jpy-aud-usd/

Weekly forex market analysis and trade ideas for the week starting 7th July 2025. Pairs covered this week include GBP/USD, USD/JPY & AUD/USD

P.S. In honor of Independence Day, I’m offering a special 55% discount on my best trading tools and education.

If you’ve been waiting for the perfect moment to level up your trading game — now’s the time!

Here is what you can get:

🎯Volume Profile Pack

15+ Hour video course

Daily/Swing trading signals

Volume Profile indicators

VWAP indicator

FREE Tech call & Indicator setup

👑Order Flow Pack:

12+ Hour video course

Order Flow software

Volume Profile software

FREE Tech call & Indicator setup

🚀VWAP Pack

9+ Hour video course

VWAP software

Volume Profile software

FREE Tech call & Indicator setup

💡Smart Money Pack

6+ Hour video course

Smart Money Software

12+ Hours of Live Trading Videos

FREE Tech call & Indicator setup

Get all four packs together and get -55% discount

Get it here:

www.trader-dale.com/volume-profile-forex-trading-course/

... See MoreSee Less

0 CommentsComment on Facebook