Hello guys,

today I would like to have a closer look at the USD/JPY.

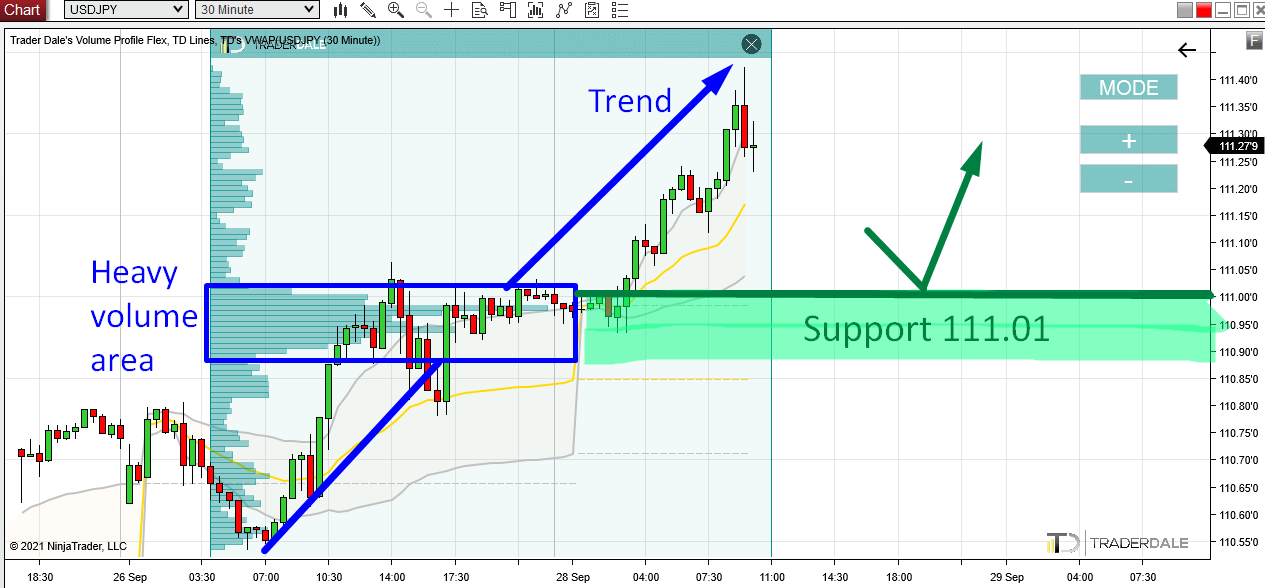

For the last couple of days this pair has been in a strong uptrend.

I am always interested in trading trending pairs and I always want to jump in the trend and participate in it.

However, I don’t just jump into the trend without any thought. I always wait for a pullback. A pullback to heavy volume area.

Why heavy volume area? Because those represent strong Support and Resistance zones.

In this case, strong institutional Buyers are pushing the USD/JPY upwards aggressively.

Volume Profile Analysis

What my Volume Profile indicator is telling me is that those Buyers were adding to their Longs around 111.01.

As you can see in the picture below, this is the area where the Volume Profile is wide = heavy volumes were traded there.

Because the uptrend continued from here, we can assume, that Buyers were adding to their Longs there (in the heavy volume area starting around 111.01)

USD/JPY; 30 Minute chart:

The heavy volume zone starting at 111.01 is an important area now. The reason is that strong institutional Buyers were adding to their Long positions there – they are clearly interested in this zone. They would not want to let the price go past it. Not without a fight.

This is the reason I think, that when there is a pullback to 111.01 those strong Buyers will want to defend this zone and this should make it a strong day trading Support.

The setup I used here is called the “Volume Profile: Trend Setup“.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

Hi Dale

I find your work and analysis exceptional, detailed and well presented

and easy to follow

I started using this in mid 1980’s and i believe it was “discovered” by a guy called Steidlemeyer

in US

I had very little detail about it but wrote software to capture a live feed from Satellite dish ..lol

It worked so well i set up a public trust to manage but for various reasons i could not do it

largely because i had to wit for windows 3 to be released in 1995 approx

i did not do all the detailed analysis you do but did look at similar

what i am intereste in is why you dont place trades based on the initial move from the major central consol area (i also found myself very confused by your used of “rotation” instead of “consolidation” – are they indeed identical??

many thanks

keep up the good work

Lindsay Hunter

61 0405 777288

PS i live in Perth, Western Australia , so this makes livev iewing very difficult, so replays are very immensely valuable

Keep up the good work, although it seems complete

Hello Lindsay,

I am glad you like my analysis and what I do!

Wow, trading with Volume Profile since 1980s that really proves how universal and working this method is! Yea, I believe the “founder” is Steidlemeyer.

You mean why I don’t place trades when the price makes a breakout? I was actually testing this out but there were quite a lot false breakouts so I abandoned this idea in the end. You are trading like this? Maybe you could give us some tip here 😉

Yea I use word rotation and I can as well use consolidation. That’s the same thing.

Cheers,

-Dale