November is over now, so let’s have a look at the statistics and see how it went. First I will recap our intraday trades for the month of November. Then I will get into the swing trades. If you trade my volume profile strategy, these monthly recaps should give you a good sample of what to expect.

Intraday Trades

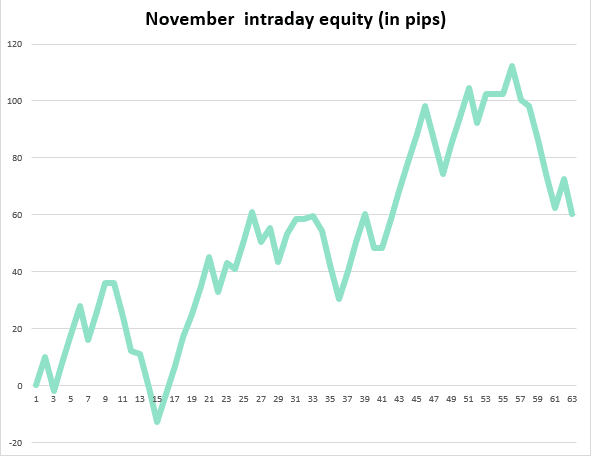

November was a very difficult month to trade as we had a great deal of back and forth. There were many cases where you needed to really stick to the rules and actively watch and adapt to the market behavior. This was especially true of any trades that setup against a strong trend. There was also a large number of trades that turned just a few pips before hitting my actual trading level.

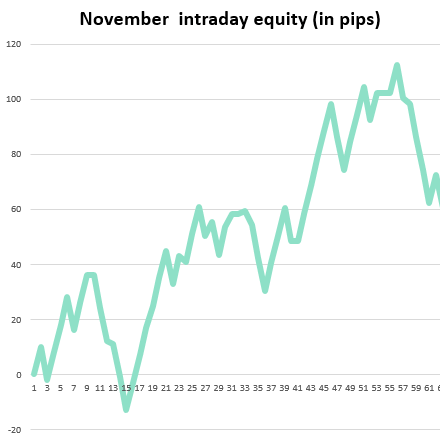

I don’t have an exact number but I guess there was about twenty of them. This happens from time to time and every trader should get used to it. With that being said, the number of potential winners that got missed in November was definitely above average and it affected the monthly result quite a lot. Below is the intraday statistics for November and it is based on my intraday levels and on trade management I described in detail in this article: How I Manage My Trading Setups

In total, there were 59 intraday trades in November. This number is a fair bit above the long-term average. It is partly because I started actively trading all reverse trades. Out of these 59 trades, there were 30 winners, 20 losers and 9 trades were closed around Break Even. The total pip result was +60 pip profit. However, I need to say that this is just a pip count. I personally took a bit smaller positions with the reversal trades since they were a new “thing” added to our official Volume Profile Strategy.

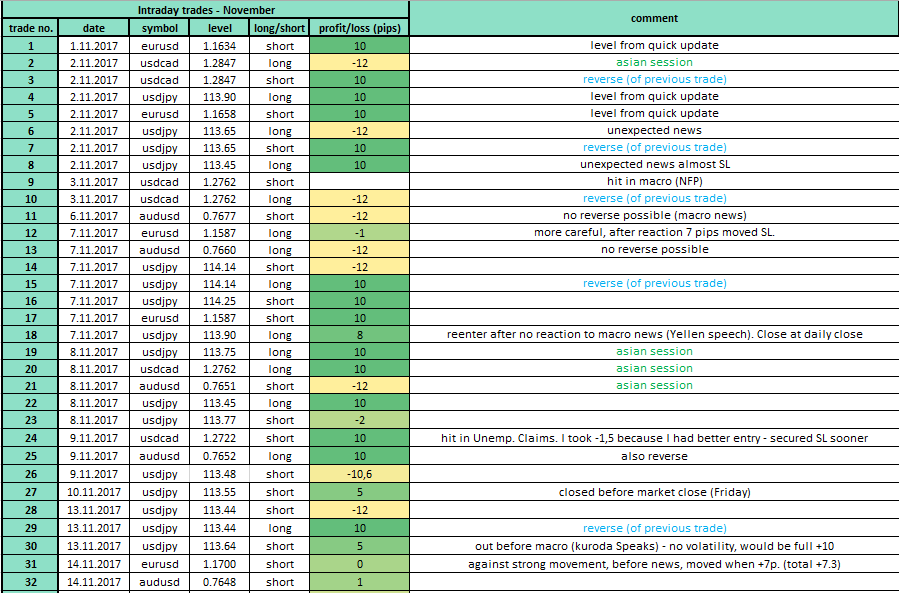

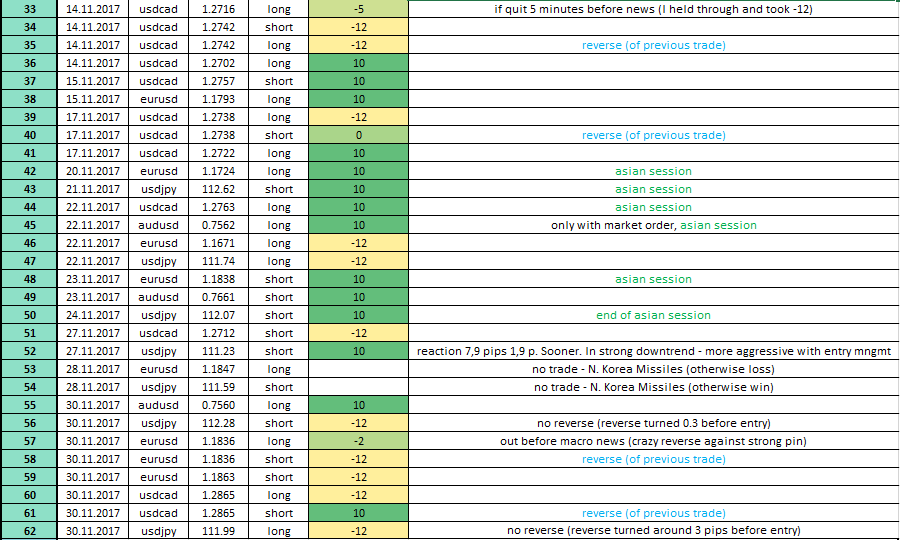

Below is a table with all the levels. This time, I also added the exact level values along with the direction of the trades. You can go through them yourself and see what levels I had and how the whole month went.

November Trade Analysis:

1.) Reversal trades: November was the first month in which I added this type of trade in the strategy. I have been using reversals for some years now, and those types of trades really aren’t anything “new”. Still, they proved to be quite profitable and turned many trades around during the month of November. I took all possible reversal trades and I only discarded those that got “tested” before the actual reversal level got hit. In November we had 9 reversal trades. 5 were winners, 3 losers, and 1 Break Even.

2.) Asian Session: The Asian session is when I sleep and for that reason, I trade it using simple limit orders and without any position management. With this straightforward application, we managed 7 winners and 2 losers in November. There was also one additional winning trade that my members (who are actively trading the Asian session) took. The reaction to my level was that precise that only those who entered the trade with market order got filled. Because I use limit order during Asia and unfortunately didn’t catch this one.

3.) If you look at the November equity you can see that something went quite wrong at the end of the month. It was the last day (30th November). This day’s trading was hugely affected by political news concerning Donald Trump investigation and also the new US Tax reform. Unfortunately, markets were driven by politics and in days like this is very hard to trade because the markets don’t really react to S/R zones.

What I noticed is that after such a bad day, the next day is usually quite the opposite. So, the best thing to do the next day is not to be afraid, but instead, trade like nothing happened yesterday. It is a hard thing to do because it is a basic human instinct to be afraid after we get a beating but it usually pays off to fight. This time it definitely did. Reactions to my S/R zones were spot on the next day. I will talk about this more in the December recap.

Swing Trades

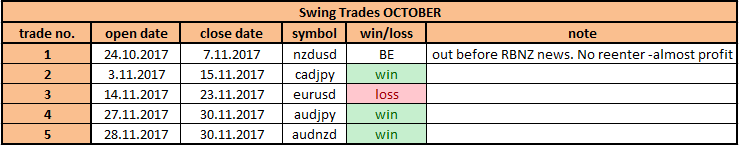

There were 5 swing trades in November. 3 winners, 1 loser and 1 closed at Break Even before significant RBNZ news.

As usual, I managed those trades with the Alternative SL approach. Here are all the trades:

That’s it, guys! I hope you had a good month and I wish you happy trading in December!

-Dale

P.S – If you would like my Daily Levels so that you can start ‘Earning While You Learn,’ then check out our Advanced Volume Profile Training Course and Members Forum for more information – Click Here to Start Learning Now

P.P.S. You can check out the previous monthly recaps here: