In today’s analysis, I would like to show you one of my favorite combinations of trading setups.

This combination does not occur too often, but when it does then I don’t hesitate to trade it.

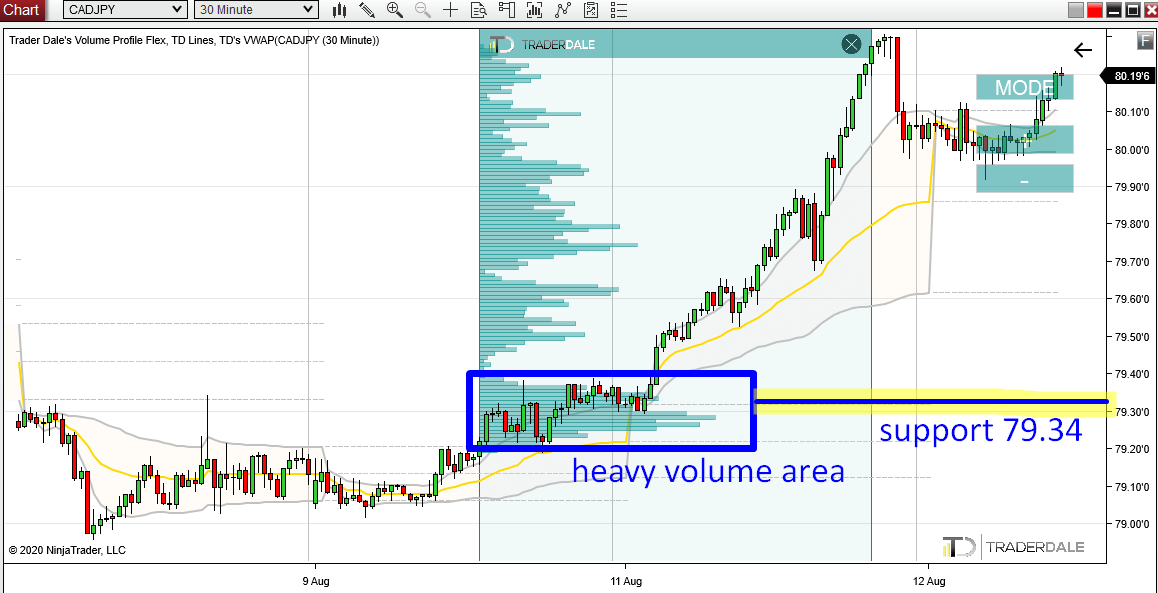

Volume Profile Analysis

The CAD/JPY was moving in a strong uptrend yesterday. It was clear that aggressive buyers were dominating the market and that they were pushing the price upwards.

Before almost every trend, there is a rotation. This case was not an exemption.

Within this rotation, there were heavy volumes traded. You can see that if you use my custom-made Volume Profile indicator.

Those heavy volumes tell us, that buyers were entering their long positions there. After they have done so, those buyers started to buy aggressively with Market orders and they initiated a strong buying activity which started the uptrend.

When the price makes it back into this area at some point in the future, then this area should work as a support.

The reason is that those buyers should become active again and they will most likely try to push the price upwards from this place again. This level was very important for them because they accumulated a lot of their longs there.

Below is a 30 Minute chart of CAD/JPY:

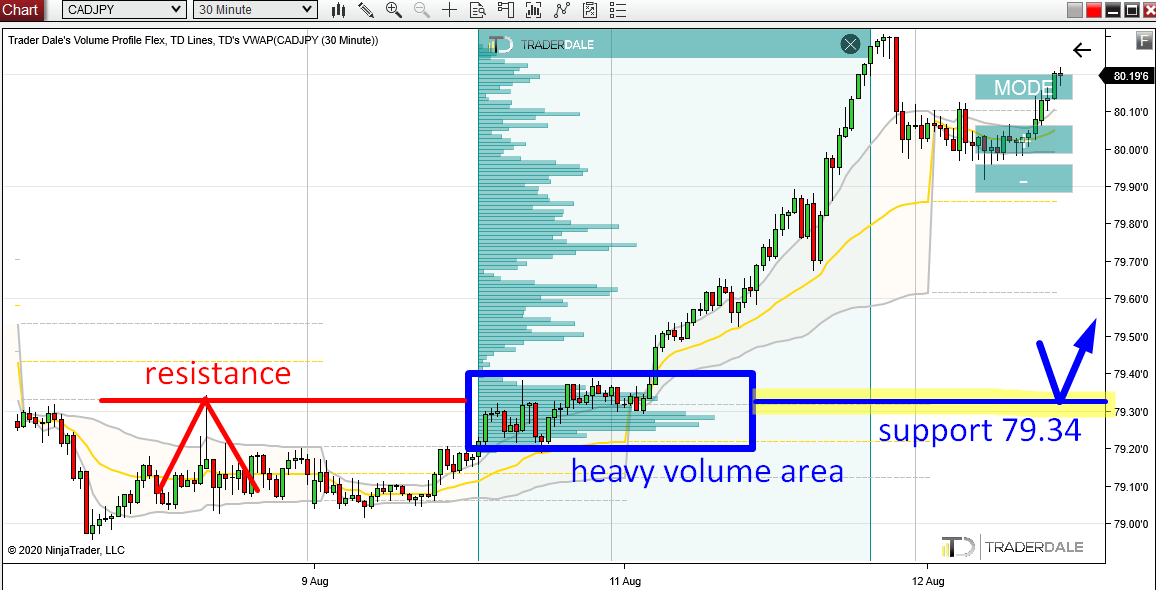

Price Action setup

Usually, I consider a support area at the place where the Volume Profile was the thickest (= a place with the heaviest volumes).

In this case however, I think the best place for a long trade is a bit higher.

The reason I think so is my favorite Price Action setup which says that a breached Resistance becomes a Support.

If you look at the picture below, you can see that the price reacted very nicely to this level before. There was a sharp rejection of it a few days back.

When the price breached this former resistance yesterday, then it turned into a new support.

This Price setup is a nice confluence with the Volume-based setup I talked about earlier.

It is also the reason why I believe, that the best place for a long trade is a little bit higher than the place where the heaviest volumes are.

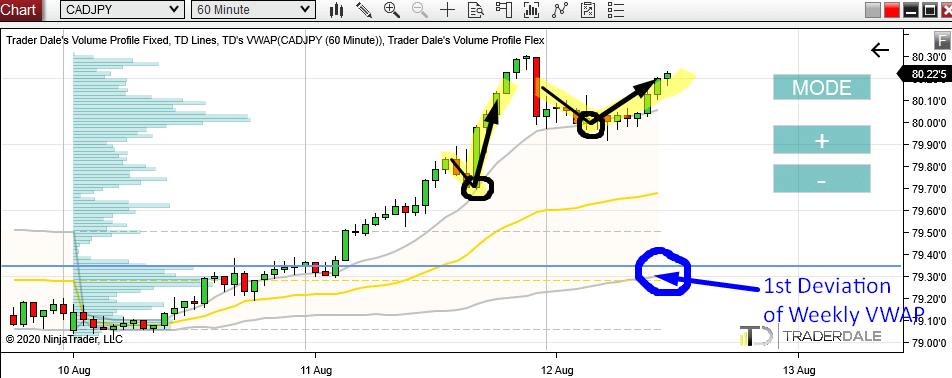

VWAP Trading Setup

The third piece of puzzle to complete this three setup combo is a setup on VWAP.

In my intraday trading I like to watch the Weekly VWAP (yellow line) and its Deviations (grey lines).

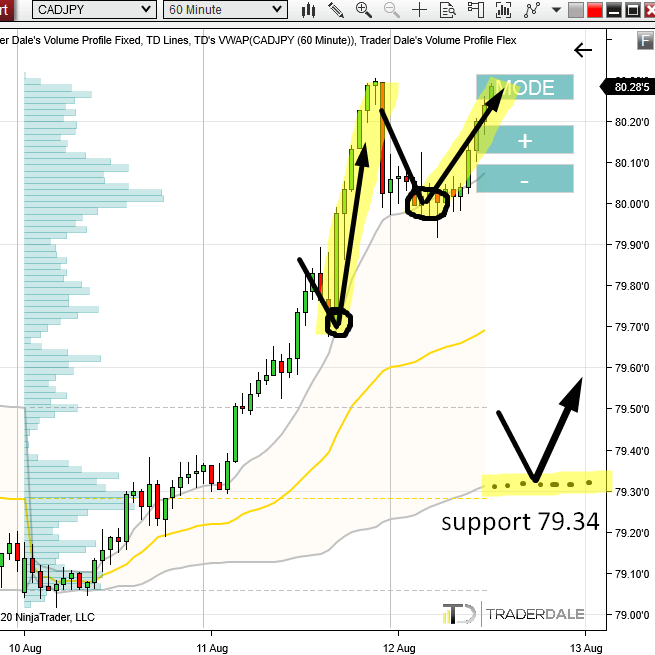

The picture below shows the same support I showed before, only this time the chart is on a 60 Minute time frame and with the Weekly VWAP.

The 79.34 support is now very close to the 1st Deviation of the VWAP (grey line).

The 1st Deviation should work as a support – as it has already done twice this week. I marked those reactions for you in the chart with the black arrows.

Summary

So, all in all we have:

- Volume- based setup

- Price Action setup

- VWAP setup

All those are pointing to one support zone. This is the confluence I like to trade and what I wanted to show you today.

I hope you guys like it. Let me know what you think in the comments below!

Happy trading!

-Dale

Thanks for the analysis Dale!

Anytime buddy!

Thanks for the analysis its an eye opener ! i will very soon join the Elite park i m very much interested in your education style.

You’re most welcome, I’m looking forward to having you as my member. 🙂

Thanks for analysis.

Have a good trading day !!!

Anytime, you too!