You can read the 1st part of this article here: How to Reach Consistency in Trading: PART 1

In my recent article, I explained to you how to reach consistency in trading. As you remember, unlike Tom, Jerry understood the core principle and was always thinking about the little tweaks to optimize his current strategy, even if it was already profitable. By saying that I think we all agree we should take some more advice from Jerry.

Tweaks to optimize your trading strategy without losing its base

Let me jump into some more details and fully explain what I mean by those ”tweaks” and how to properly apply them without losing your base strategy’s principle.

The base strategy principle is the core of the strategy. The thing your strategy is built around. This is what gives you an “edge”. An edge is the one thing you always need to maintain no matter how you tweak your strategy.

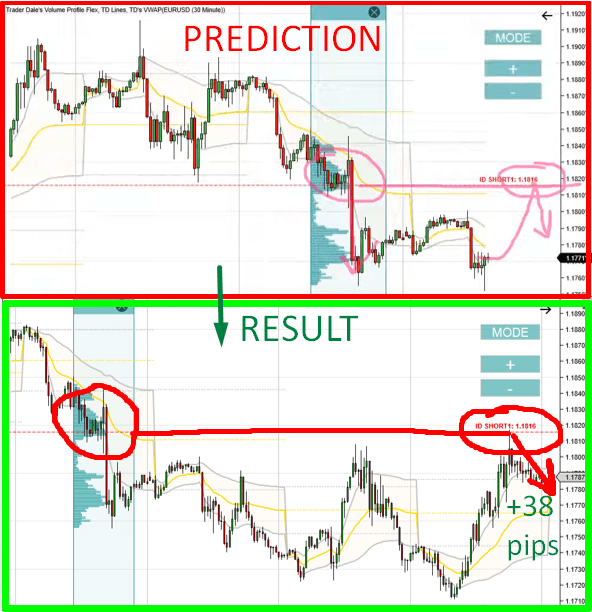

Our edge is a tendency of price to make an reaction to the Point Of Control (POC). That will be our base we won’t move from because we already have many proofs it works.

Like for example in the picture below: Prediction from Monday, and a nice reaction to a local POC two days later.

Intraday Trading TWEAK #1

My main tweak for intraday trades is NOT TRADING DURING NEWS EVENTS. I didn’t come up with it out of nowhere, but I backtested the last year of my trading history and wrote results for ”what would it be like if I never entered a trade during strong news”.

The result was impressive; my P/L would end up ~20% higher! It was because of the fact that POCs which got hit during news events often got ignored and price just shot past them in it’s strong, news-impacted movement.

Of course, that the first thing I did after finding it out was accepting new rule in my current strategy: to never trade during strong news.

This was quite a long time ago. Since then, not trading during the macro news has become quite natural for me.

Intraday Trading TWEAK #2

Other tweak of mine is HAVING 2 PIPS WIDER STOP LOSS (compared to Take Profit) in intraday trading. This actually gives me slightly negative RRR.

There were plenty of people asking me how come? How can I trade with negative RRR and still be profitable? The answer is simple; I just backtested my account history and wrote a result for ”what would it be if I had just 2 pips wider stop loss? Would it save some of my losers and turn them to winners?”.

That’s exaclty what happened. Although I was losing more then I was getting, it managed to save some of my trades and turn them into profits instead of losers. At the end of my backtest it showed as ~10% more in my P/L!

Also those 2 extra pips give me some more room to actively manage my trades using Order Flow.

Again, I took it as my new rule.

Exactly the same thing happened when I started using a method which I call the “Alternative Stop Loss” in my swing trading. In this case, the P/L went up to even ~15% more!

Swing Trading TWEAK

One of my old members from my Volume Profile Training Course has been backtesting and modifying my swing trading strategy every few months for over a year. He is already at the point where he would have 59% higher P/L if he was trading like his latest modification from start.

In backtesting you always want to be sure to use your whole trading history, not just the last few months.

Also, be sure to have enough data since the latest modification to even know whether and how it works (I would recommend 100 intraday or 30 swing trades in between of modifications).

Please note that the 59% increase in the P/L at the end of the year is an extreme case.

However, I noted it so you guys know that it’s possible. All that really separates you from higher returns is just hard work on backtesting ”what if” situations while not moving from your base edge.

Things like that are exactly why we have to make some tweaks to our edge in order to get better returns, instead of trying to find a new ”better” edge.

How to get started

What I recommend is to start with a trading strategy I have already explained (whether it’s intraday or swing) and trade it for a few months to get some consistent account history. This will allow you to work with this history later.

Also, keep a detailed trading diary because you will need it for all the backtests and ”what if” situations in the future! I would recommend using Excel.

Do you want ME to help YOU with your trading?

Simple tweaks to your strategy

In my last article, I said that the little tweak could be for example using a different Risk Reward Ratio, trading with different time frames, changing the way of quitting your trades, etc…

Now, I will give you more of them even more explained, to be sure you understand me completely.

I’m sure you heard that old saying ”simplicity is the key” or ”K.I.S.S” which stands for ”keep it stupid simple”.

Over-optimized strategies tend to give you perfect results in the past but fail in the future as I explained in my previous article. We must be sure to have it simple and robust, so here are some good tweaks for you:

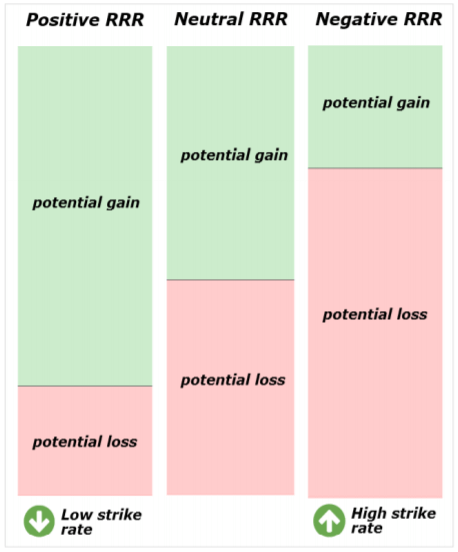

1.) Risk Reward Ratio (RRR)

I am putting this one to the first place for a reason. I mainly teach trading with around 1:1 RRR because many people are still beginners and I think that RRR around 1 is the best starting point.

RRR around 1 also leaves less room for rookie mistakes and it is also easier to trade like this from psychological point of view (it is easier for your mind).

After you had been trading with 1:1 for some time time and you had seen that my winning trades usually reacted exactly at POC. And at the top of that they made much more that 1:1, why wouldn’t you take advantage of it?

So, what I suggest at this point is tightening your stop loss range and/or widening your take profit range. By each of these you are making your RRR bigger.

*I personally prefer stretching Take Profit to SL tightening as I like to let the trades breathe.

Bigger RRR is not “better”

Have in mind that bigger doesn’t always mean better. Too big RRR can actually make our win-rate so small that we won’t make any progress.

Imagine a real situation which happens quite often: You trade with a high RRR, for example RRR = 5. That means your SL is tight and Take Profit is really far. You will have many losing trades and only a few winners.

Tough luck is also sometimes a part of trading (Murphys law) and because of this, you fail to take (or execute properly) the one trade that would cover your 5 consecutive losers you took recently. What do you think this does to your head?

You would need to be a really good and experienced trader to let this be with a clear head and continue trading like nothing happened!

Let’s get back to tweaking your strategy now. You must know exactly why are you tweaking it instead of doing it without any thought.

For example, you keep seeing your Stop Loss being hit by a few pips and then returning other way into a full profit. In that case you obviously have a concrete reason for modification of widening your Stop Loss range.

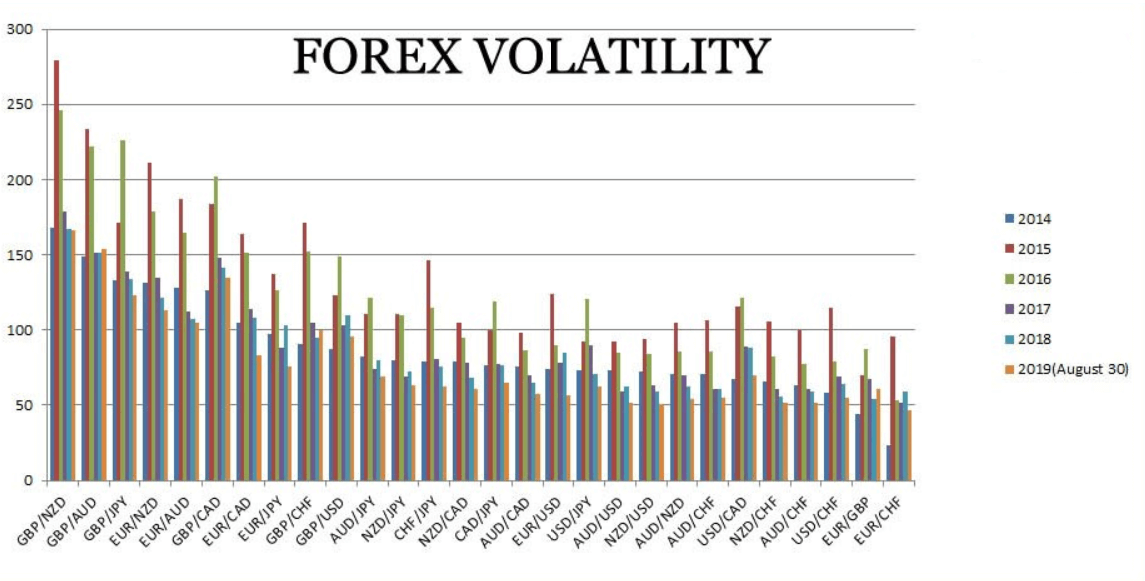

2.) Using ADR/ATR for position management

ADR stands for ”average daily range” and ATR stays for ”average true range”. The only difference between them is that ADR includes gaps and ATR doesn’t (note that forex almost doesn’t have any gaps).

This indicator tell us how many pips in the last ”x” days the currency pair moved on average. Using one of these indicators can help us in deciding how big our Stop Loss and Take Profit range should be.

Let’s look at this table and consider an example: we want to place 2 trades, one is on GBP/NZD and the other is on EUR/CHF.

My intraday trading strategy tells you to use 10 pips Take Profit target and 12 pips Stop Loss target (for most of Major FX pairs). The question is: should you place it like that on both GBP/NZD and EUR/CHF pairs?

Of course no. As you can see from the picture above, GBP/NZD daily range is almost the triple of EUR/CHF range.

That’s the reason why whatever we decide our Stop Loss and Take Profit range on EUR/CHF will be, we have to triple it on GBP/NZD because of its much higher volatility.

*Placing ADR/ATR on your MT4 platform is very simple: insert – indicators – Average True Range – type in how many days you are interested in and click ”OK”. Now you have your Average Daily Range indicator,

3.) Early tests

Since I place my trades directly at POC, the price sometimes doesn’t come all the way to it. It sometimes makes the anticipated reaction a few pips before reaching the level at POC.

In such a case, those high volumes at POC are already tested. I don’t want to risk it any more (second tests of POC levels have lower win-rate) so I discard my trade.

Now, we have two options how to use that observation in our favor. The first option is just call it early test and discard it as I explain in my Volume Profile Course.

But why stop there and not make a small tweak here? There is one more option which is placing trades a few pips before POC. In that case we won’t miss those “early tests” and we can trade all the nice reactions, even if they occur a bit before the POC.

*I personally like to use this method in calmer periods like in: low volatility periods, holidays, summer, around Christmas, etc.

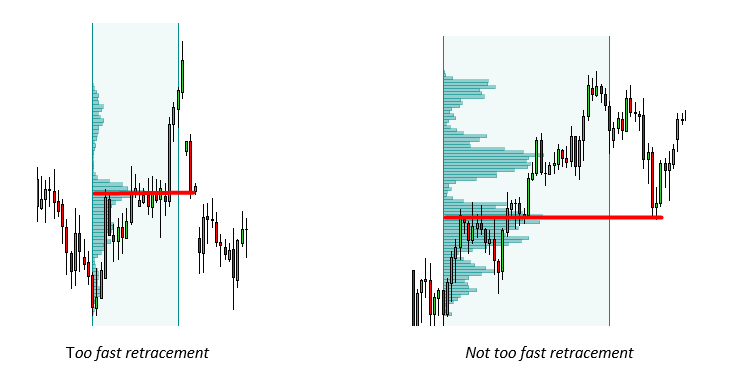

4.) Too fast retracement

When there is Volume Accumulation followed by strong activity and that strong activity gets squeezed by even stronger activity against it, I don’t want to take the trade anymore. That’s because there is the risk that we would not be on the stronger side of the market.

Below are two pictures. The first picture shows a very fast retracement and aggressivity of sellers. In this case I would not really be into entering a long trade against it.

The second picture, however, does not show such an aggression of sellers. Therefore it would be okay to enter the long there from the Volume Accumulation area.

5.) Weak highs/lows & failed auctions

Weak highs/lows and failed auctions are places the price is likely to shoot through. That’s why I also use them to filter out bad trades.

It would take a bit to long for me to explain them here, but I did an in-depth analysis and explanation of them in my book: ‘‘Volume Profile – The Insiders Guide to Trading” which you can download for FREE by hitting the banner below.

6.) Making various filters

Filtering out bad trades is as useful as adding up winning trades. There are plenty of filters you can come out with.

Remember, that they deserve much of your time backtesting to see if they are useful and if they can actualy help your trading strategy & results.

Here are two more of them which you can try. They all start with ”DO NOT TRADE IF”:

– There aren’t at least 2 consecutive strong one-way candles after accumulation you look to trade from.

– There is a huge market uncertainty (coronavirus, war, elections,…

Conclusion

As every job in the world, trading not only requires proper knowledge but also a big amount of time invested into getting a real hands-on experience.

This article’s idea is to teach you where to invest your time the most if you want to get to history-proven consistently winning trading system.

Work on analyzing and backtesting the ”what if” situations using various tweaks and I can guarantee you that it will make you a way better trader, with far better results!

You can read the first part of this article here: How to reach consistency in trading – PART 1.

I hope you guys found this article helpful, let me know what you think in the comments below!

Happy trading!

-Dale

the biggest mistake we all beginner traders do, is not Back-testing the strategy or trading style and try to collect data history about it

yeah for me i start see my win rate fly, after i start note all my win and loss trade and predict why i loss. take screenshot ….ect

Conclusion : the more data history we collect = profitable trading system

Thank’s Dale for the article it realy help

I completely agree with you buddy, I’m glad it helped you. Sometimes we all need to hear things like this although we already know it. 🙂

I spent long time for backtesting. It make me feel confidence. And improving my trading skills.

That’s great, keep it up!

Thanks so much for this article Dale!

I really appreciate it because for the first time I now realize huge mistakes costing me a lot in my trading:

1. Not being detailed in my trading journal (analyzing post- trade outcomes)

2. Not back-testing

3. Not adjusting my stop loss based on ATR

Thank you very much for this article.

It’s an eye opener

You’re most welcome Godwin. It’s important to become aware of our mistakes first, I’m glad it helped you.

Can we talk on phone?

Italy

email is the best way to catch me if you don’t mind. It is: contact@trader-dale.com