*This is Q/E from my Price Action Webinar. If you missed it, then here is a recording:

Hello guys,

in the recent Price Action Webinar, I received a couple of questions that I did not have time to answer. I will answer them here so everybody can benefit from them. Here are the questions in no particular order:

Q: What would be the strategy to trade when the price is in a rotation?

I have two strategies. One is based on Volume Profile, the other one is based on VWAP.

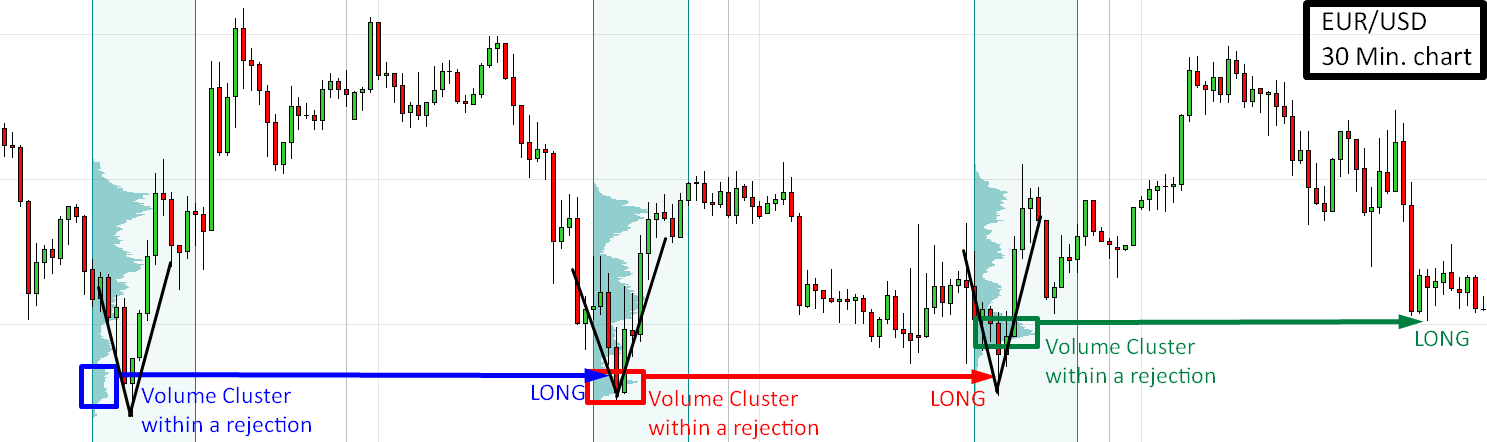

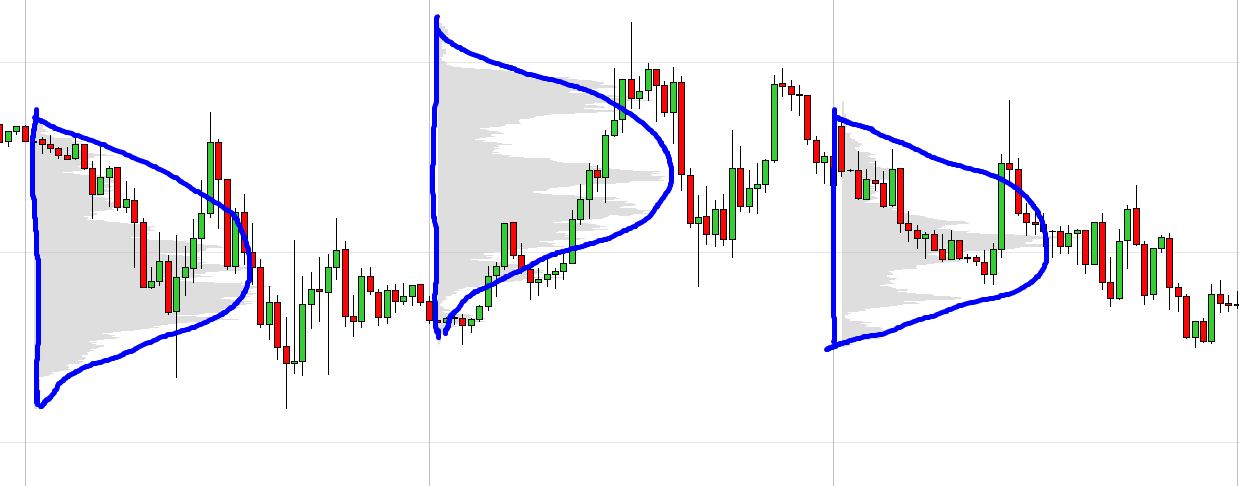

Volume Profile strategy: look for significant rejections of higher/lower prices. Then look for significant Volume Clusters within these rejections. Trade from those as in the picture below:

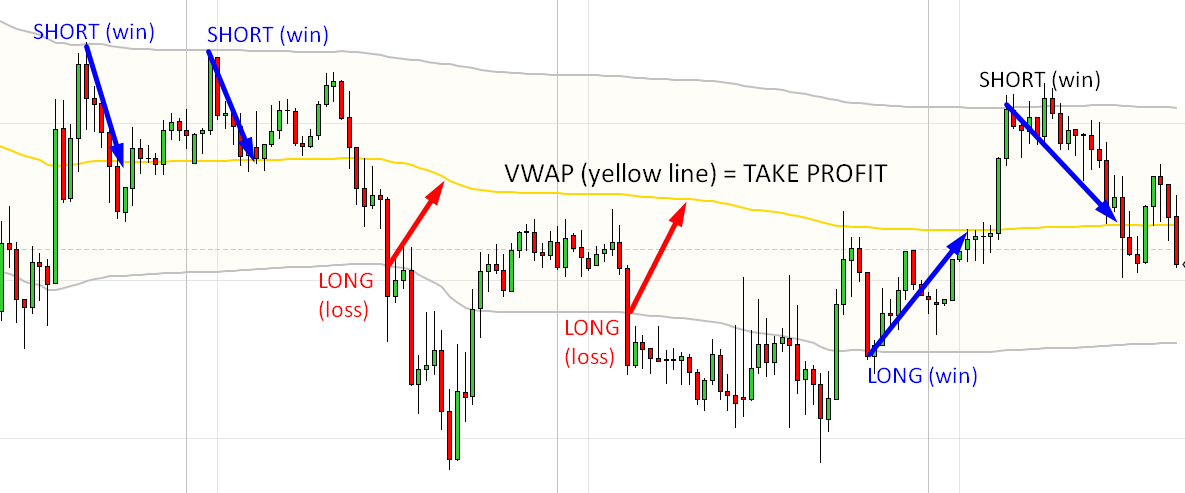

VWAP Strategy: VWAP (yellow line) and its first deviations (grey lines) need to go more or less sideways. This will tell you that there is a rotation. The price needs to move within the area between the first deviations. It if is like this, then the first deviations work as S/R zones.

When the price hits the upper grey line, you go Short, when the price hits the lower grey line, you go Long. Take Profit is the VWAP line (yellow). VWAP represents a “fair price” and the market price tends to return back to it as if it were a magnet.

You can learn more about my VWAP strategies in this webinar:

WEBINAR: VWAP Trading Strategies

*BTW you get VWAP indicator as a part of my ELITE PACK (educational & indicator pack).

Q:How to identify the end of a trend?

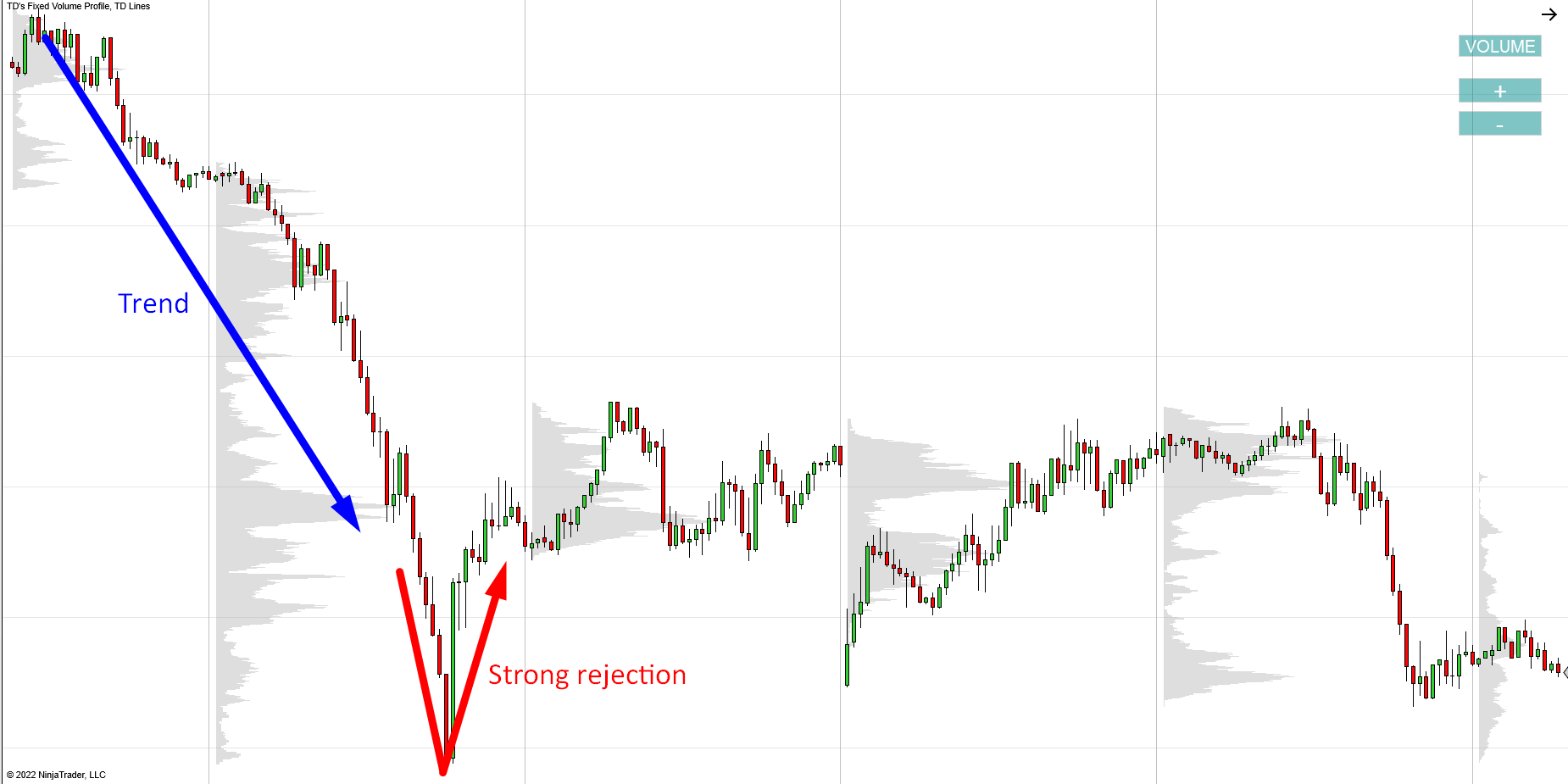

If there is a strong rejection after a trend, then it usually means that the trend is over (at least temporarily).

In the picture above, you see a strong downtrend. Then Strong and aggressive Buyers started to jump in and they fought the Sellers. They made that strong rejection of lower prices, which became a very significant point after it got formed. From this place the price could either go into a new uptrend or into a rotation (that’s the case in this example).

Q: How do we identify a rotation?

There are more ways how to do this. The first, most common one, is to look at the chart and with a bit of practice and experience you should be able to tell. However, there are tools to help you. I prefer to use Volume Profile.

How to identify a rotation with Volume Profile:

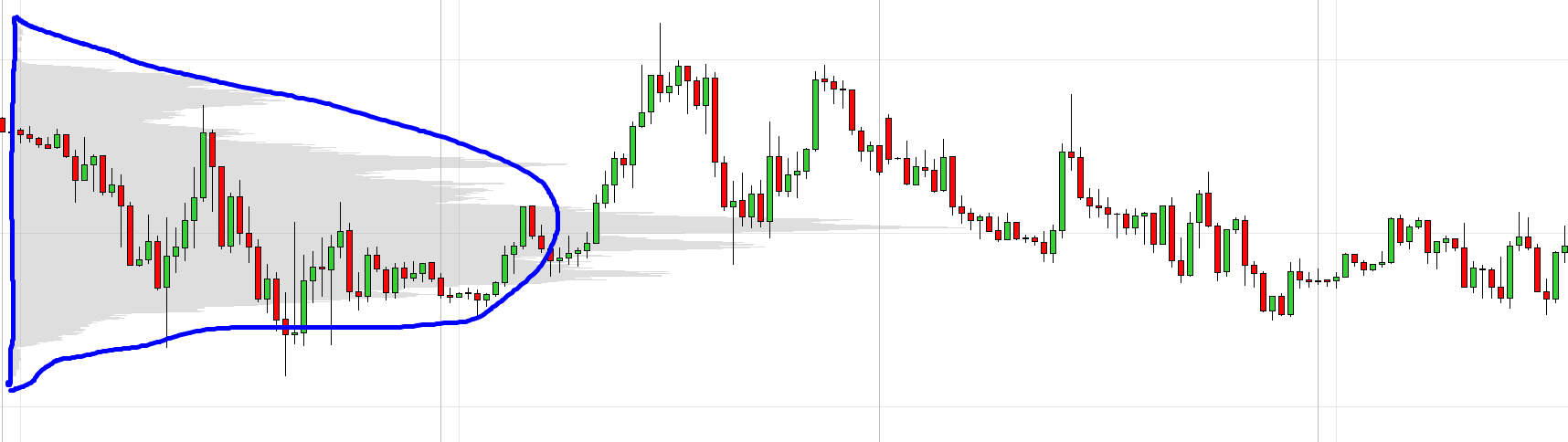

Rotation is when Volume Profile is in a shape of a letter D (like in the picture below). D-shaped Volume Profile tells us, that the heaviest volumes are being accumulated somewhere in the middle of the rotation. Less volumes are around the borders. This signals that the market is in a temporary balance.

It’s good to look at long-term Volume Profile that shows a higher perspective. So, for example, if you are looking at 30 Minute time frame, then look at Weekly Volume Profile (shows volume distribution throughout the whole week).

If you use for example Daily profiles, then they will show you more smaller rotation areas.

This is how the chart looks with Daily profiles. These also show a rotation, but it’s not as easy to identify as if you used a”bigger” Volume Profile as in the picture above.

Do you want ME to help YOU with your trading?

Q: Wouldn’t Order Flow show you if there is an accumulation of buying/selling in a rotation area?

The short answer is unfortunately “no”.

Order Flow shows executed trades on Bid and Ask side. The problem is, that a trade on Bid is not always Sell, it could also be a Limit Buy. Also, a trade at Ask is not always a Buy, but it can also be a Limit Sell.

Confusing? Then watch this webinar:

WEBINAR: Order Flow Trading Setups

When there is a rotation, the big trading institutions use both orders – Market Orders and Limit Orders. This way they can hide their activity – hide whether they are buying or selling.

When there is a long rotation, Order Flow doesn’t help too much in identifying Buyers/Sellers.

I know, there are people who say otherwise. But if they do so, then they are either lying or they don’t really understand how Order Flow works.

There are many ways how Order Flow can significantly help you in your trading (and you can learn all this in my Order Flow course), but this is not one of them.

Q: What time frame to use for identifying a rotation?

That depends on the primary time-frame you use for your trading. I use primarily 30 Minute TF for my intraday trading and Daily time frame for swing trading.

Q:What Win/Loss percent do you expect to have on the 1 minute TF?

Definitely smaller than on higher time frames. The reason is that on 1 minute time frame, there is a lot of noise. The higher time frame you use, the more noise you filter out. I personally consider trading on 1 Minute TF risky.

Q: Do you simply put limit order or which confirmation do you wait for at the level?

If it is a clear and strong level based on more trading setups (for example Price Action + Volume Profile setups) then I don’t need a confirmation and I am okay with using Limit Order. BTW I use my Trade Manager to withdraw all Limit orders before macro news release.

If the level is not so clear, if it’s a wider S/R area, or if its based just on one trading setup, then I want to use Order Flow for trade entry confirmation.

Q: You wait nearly two months to take a trade? (that was a question regarding one specific example).

Yes and I am okay with that. I trade around 15 trading instruments and if there is a strong S/R level I would like to trade, then I don’t mind waiting for the price to reach that level. There are always other opportunities on other markets and other time frames, so it’s not like I wait 2 months and do nothing in the meantime 🙂

Q: Can’t you scalp with the same idea on lower time frames as limit orders take forever.

Yes, you can use the methodology I showed you on faster time frames. I recommend not using on faster TF than 5 Minute charts, because of the noise I mentioned before.

Comment from Francesco: Applied right, from long term experience my results are around 62-64% hit rate with 1:1 RR

I know this is not a question, but I wanted to comment on this.

A lot of people around the internet talk big about trades with 80%-90% win rate. Never ever in my life (and I have been trading since 2008) I saw a strategy that would have such a win rate in the long-term. And it’s not just me.

I was reading interviews with famous traders and they have confirmed my experience. Which is: In the long-run, there is not a strategy, that would have over 70% win rate. If you have a strategy with 60-65%, then you have won in this game! Stick to it! That’s all you need to be profitable.

Q:What RRR (Risk Reward Ratio) do you shoot normally for your SL and TP?

I prefer RRR around =1, or slightly positive. Only rarely I take trades with a very positive RRR over 2. It’s a psychological thing and I found out that this suits me best.

I tried it all in the past. I traded with massively negative RRR (which was obviously resulting in huge win rate) and massively Positive RRR which resulted in a very small win rate (but the bigger winners).

I think this is up to everybody to decide what RRR fits them best. Generally speaking, many people are not able to hold trades with high RRR (2 and more) because this method generates a lot of losing trades. Also its very mentally difficult to be able to hold a trade for a long time to reach RRR over 2 and more. It looks good on paper, but in reality it’s just hard. At least for most people (including me).

Q: Do you scale in or scale out? Do you Average down your entry?

Generally speaking no. I use Averaging down only with long-term stock investing and only to some extent. Nothing too dramatic.

Q: ABCD setup works better at some S/R level or always?

It does work as a stand-alone strategy and I was trading it like this in the past. However, I now prefer to combine it with other trading strategies. I like to see confluences of more strategies around my S/R levels. With AB=CD it could be for example one of my Volume Profile setups.

Q: How do you implement the Volume Profile on NinjaTrader?

Volume Profile is my custom-made tool and you first need to install it. Members of my Elite Pack and Order Flow Pack courses receive a free tech support that will do all this for them.

The other way is to follow a Quick Guide that you get along with the purchase of my Volume Profile.

Q: What time do you do daily market analysis?

Before the start of the US session and then before the start of the Asian Session.

Q: Are all your indicators and programs for NinjaTrader?

Volume Profile, VWAP, and Order Flow are for NinjaTrader 8.

I also have Volume Profile and Trade Manager for MT4.

Q: I use the TradingView platform can I use you profile on that platform?

Unfortunately no, my Volume Profile is only for NinjaTrader and MetaTrader.

Q: Does the Trade Manager software work for crypto trading?

Yes it does.

Q: Do we need to purchase NinjaTrader?

No, you don’t. You can use my indicators with the free NT8 version. I have been using their free version for years myself. There is no need for the purchase.

Q: Is the Trade Manager software for NinjaTrader or MT4?

MT4.

Q: Does the Tech support come with the Elite Pack purchase?

A: Yes it does. Jason – our tech guy will install your NinjaTrader, connect to datafeed, install all indicators, load my own workspaces,… All while you sit and relax 🙂

I would like to thank you all for the nice feedback and positive attitude at the webinar. It was my pleasure doing it for you guys!

-Dale

P.S. At the end of the webinar I made a special -52% offer on getting my best educational & indicator packs.

You can get the special discount here until Friday:

Elite Pack: https://www.trader-dale.com/volume-profile-forex-trading-course/

Order Flow Pack: https://www.trader-dale.com/order-flow-indicator-and-video-course/

Hey Dale, the Franseco comment was actually by me, and I want to add that in line with your article, my hit rate on 5 min charts is actually lower (60%), so I agree that the rate goes lower as you look at shorter time-frames. Furthermore, whenever I try to beat my own system (i.e. when I refrain from taking certain trades or wait for better levels), it more often then not fails. This is an important lesson as well: Never try to beat your own system!

hello franseco. can u please explain to me that how to “Never try to beat your own system!” i dident understand it