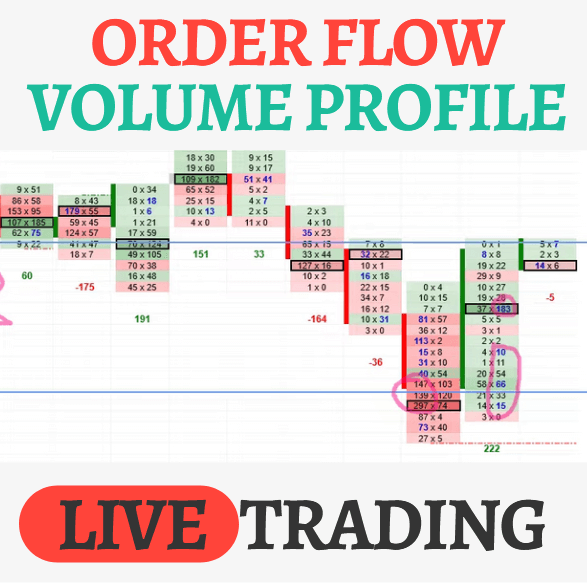

Order Flow & Volume Profile Live Trading (USD/CAD Futures)

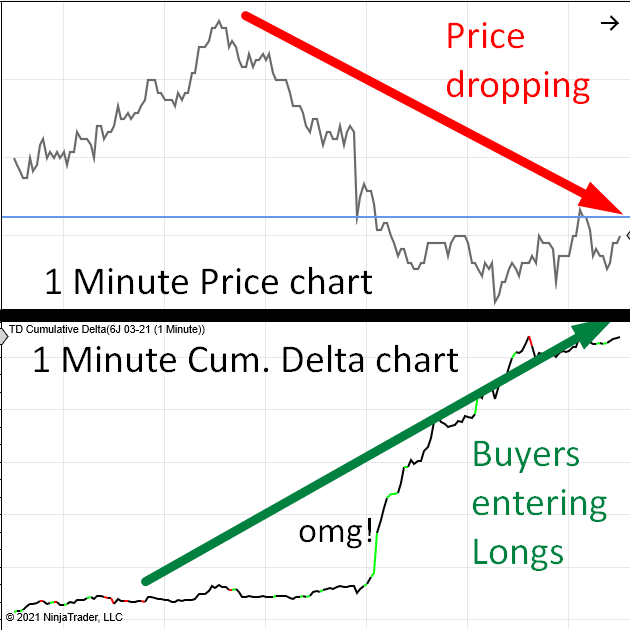

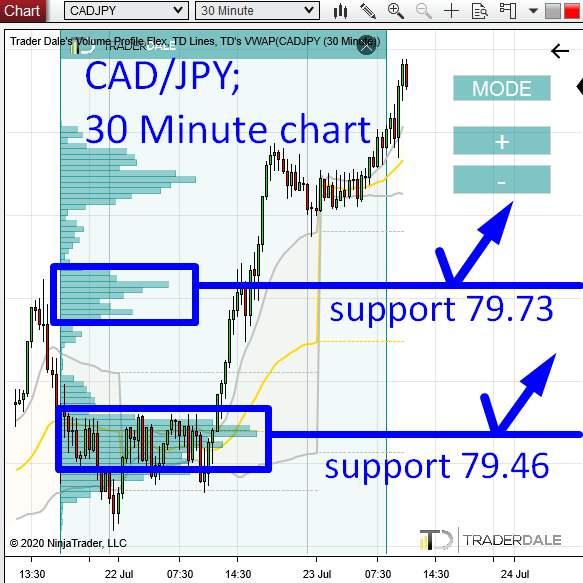

This Live Trading video shows my trading session using Order Flow and Volume Profile. I show how to use those tools to identify the best places for trade entry and trade exit.

Order Flow & Volume Profile Live Trading (USD/CAD Futures) Read More »